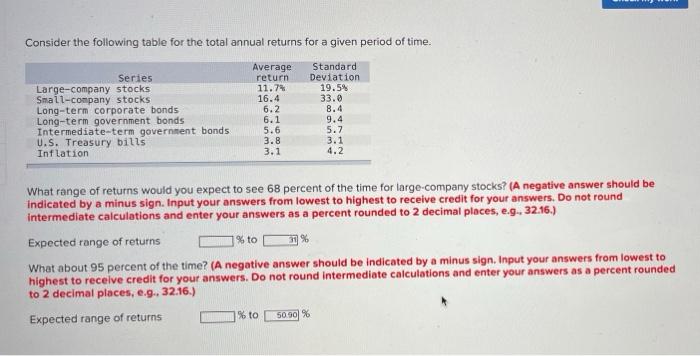

Question: Consider the following table for the total annual returns for a given period of time. Series Large-company stocks Small-company stocks Long-term corporate bonds Long-term government

Consider the following table for the total annual returns for a given period of time. Series Large-company stocks Small-company stocks Long-term corporate bonds Long-term government bonds Intermediate-term government bonds U.S. Treasury bills Inflation Average return 11.74 16.4 6.2 6.1 5.6 3.8 3.1 Standard Deviation 19.59 33.0 8.4 9.4 5.7 3.1 4.2 What range of returns would you expect to see 68 percent of the time for large company stocks? (A negative answer should be Indicated by a minus sign. Input your answers from lowest to highest to receive credit for your answers. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g.. 32.16.) Expected range of returns % to What about 95 percent of the time? (A negative answer should be indicated by a minus sign, Input your answers from lowest to highest to receive credit for your answers. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g. 32.16.) Expected range of returns % to 50,90 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts