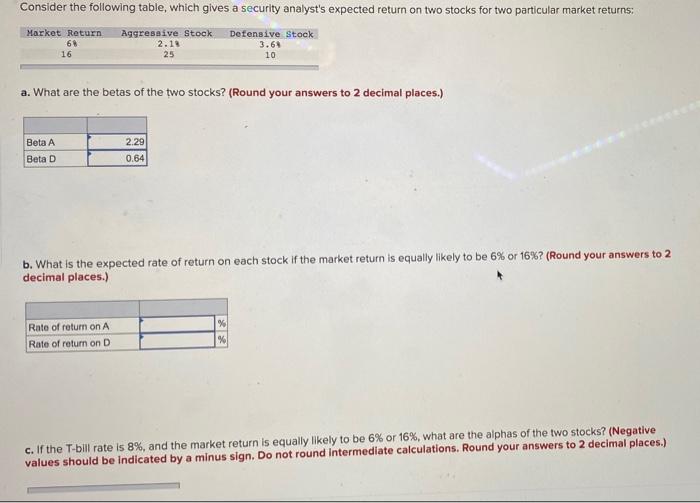

Question: Consider the following table, which gives a security analyst's expected return on two stocks for two particular market returns: Market Return 68 16 Aggressive Stock

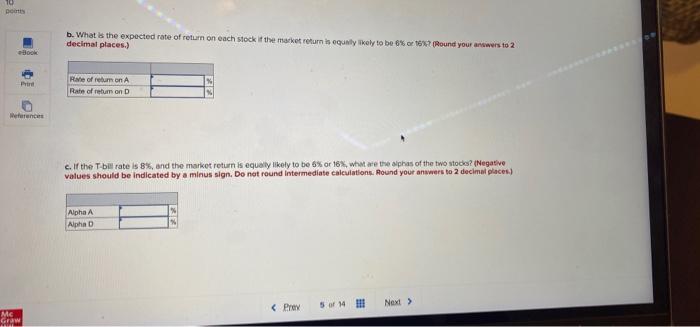

Consider the following table, which gives a security analyst's expected return on two stocks for two particular market returns: Market Return 68 16 Aggressive Stock 2.18 25 Defensive Stock 3.64 10 a. What are the betas of the two stocks? (Round your answers to 2 decimal places.) Beta A Beta D 2.29 0.64 b. What is the expected rate of return on each stock if the market return is equally likely to be 6% or 16%? (Round your answers to 2 decimal places.) Rate of return on A Rate of return on D c. If the T-bill rate is 8%, and the market return is equally likely to be 6% or 16%, what are the alphas of the two stocks? (Negative values should be indicated by a minus sign. Do not round Intermediate calculations. Round your answers to 2 decimal places.) 10 Dents b. What is the expected rate of return on each stock if the market return is equally likely to be 6% 16? Pound your answers to 2 decimal places.) Rate of return on A Rate of return on D Weference c. If the T-bill rate is 8%, and the market return is equally likely to be 6% or 16%, what are the alphas of the two stos? (Negative values should be indicated by a minus sign. Do not round Intermediate calculations. Round your answers to 2 decimal places) Alpha A Alpha D ME GE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts