Question: Consider the following three financial securities: Security A: a two-year default-free bond with a face value of $100, a coupon rate of 3% and

![(e) What is the present value of security C? [4 marks] (1) Suppose that after one year the price of security](https://dsd5zvtm8ll6.cloudfront.net/questions/2023/10/6539f9ce00d0e_1698341542848.jpg)

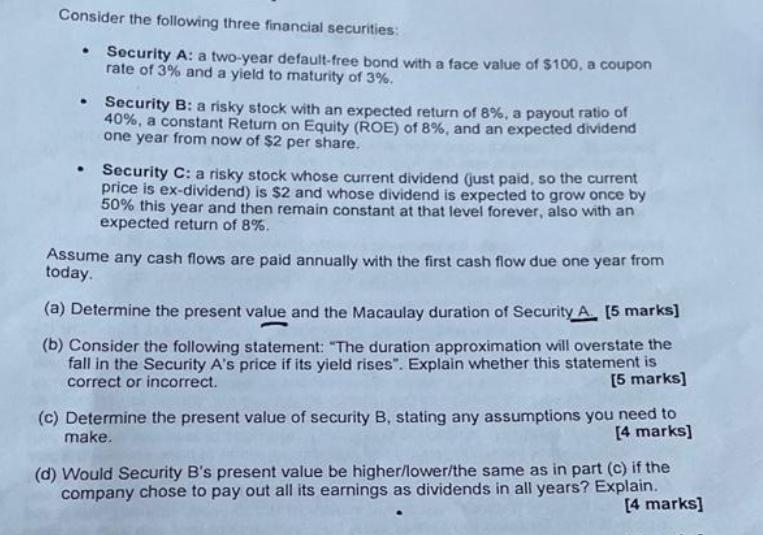

Consider the following three financial securities: Security A: a two-year default-free bond with a face value of $100, a coupon rate of 3% and a yield to maturity of 3%. . Security B: a risky stock with an expected return of 8%, a payout ratio of 40%, a constant Return on Equity (ROE) of 8%, and an expected dividend one year from now of $2 per share. Security C: a risky stock whose current dividend (just paid, so the current price is ex-dividend) is $2 and whose dividend is expected to grow once by 50% this year and then remain constant at that level forever, also with an expected return of 8%. Assume any cash flows are paid annually with the first cash flow due one year from today. (a) Determine the present value and the Macaulay duration of Security A. [5 marks] (b) Consider the following statement: "The duration approximation will overstate the fall in the Security A's price if its yield rises". Explain whether this statement is correct or incorrect. [5 marks] (c) Determine the present value of security B, stating any assumptions you need to [4 marks] make. (d) Would Security B's present value be higher/lower/the same as in part (c) if the company chose to pay out all its earnings as dividends in all years? Explain. [4 marks] (e) What is the present value of security C? [4 marks] (1) Suppose that after one year the price of security B declines while the price of all default-free bonds is unchanged, and the price of security C declines by only half the decline of B. Discuss the different possible reasons why security B's price has declined, assuming that there is only one common risk factor to asset returns and that the three securities' sensitivities to this risk factor do not change. Make sure your reasons account for the observed behaviour of securities A and C. [6 marks] (g) Consider another security, Security D, with an expected return of 10%, which pays $1.50 in one year, with subsequent annual payments growing by $0.50 per [6 marks] year, forever. Determine the present value of security D.

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

a Determine the present value and the Macaulay duration of Security A Present value of Security A PV Face value 1 Yield to maturityTime to maturityPV 100 1 32PV 9104 Macaulay duration of Security A Ma... View full answer

Get step-by-step solutions from verified subject matter experts