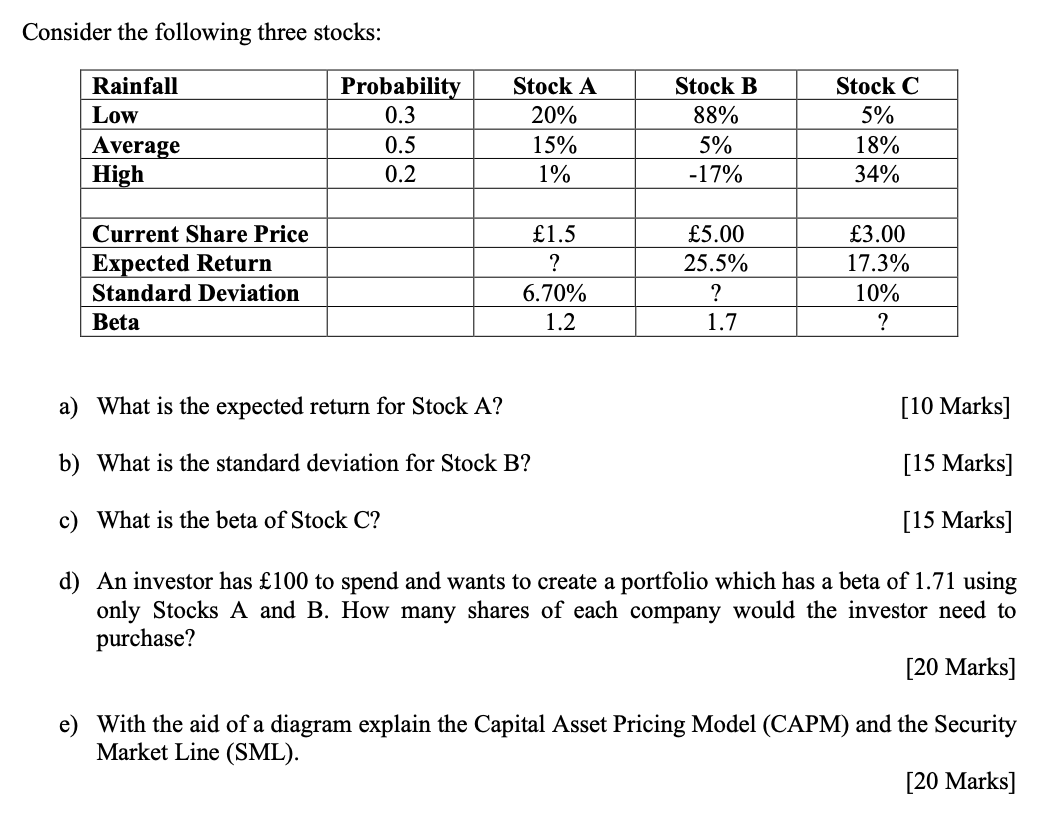

Question: Consider the following three stocks: Rainfall Low Average High Probability 0.3 0.5 0.2 Stock A 20% 15% 1% Stock B 88% 5% -17% Stock C

Consider the following three stocks: Rainfall Low Average High Probability 0.3 0.5 0.2 Stock A 20% 15% 1% Stock B 88% 5% -17% Stock C 5% 18% 34% Current Share Price Expected Return Standard Deviation Beta 1.5 ? 6.70% 1.2 5.00 25.5% ? 1.7 3.00 17.3% 10% ? a) What is the expected return for Stock A? [10 Marks] b) What is the standard deviation for Stock [15 Marks] c) What is the beta of Stock C? [15 Marks] d) An investor has 100 to spend and wants to create a portfolio which has a beta of 1.71 using only Stocks A and B. How many shares of each company would the investor need to purchase? [20 Marks] e) With the aid of a diagram explain the Capital Asset Pricing Model (CAPM) and the Security Market Line (SML). [20 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts