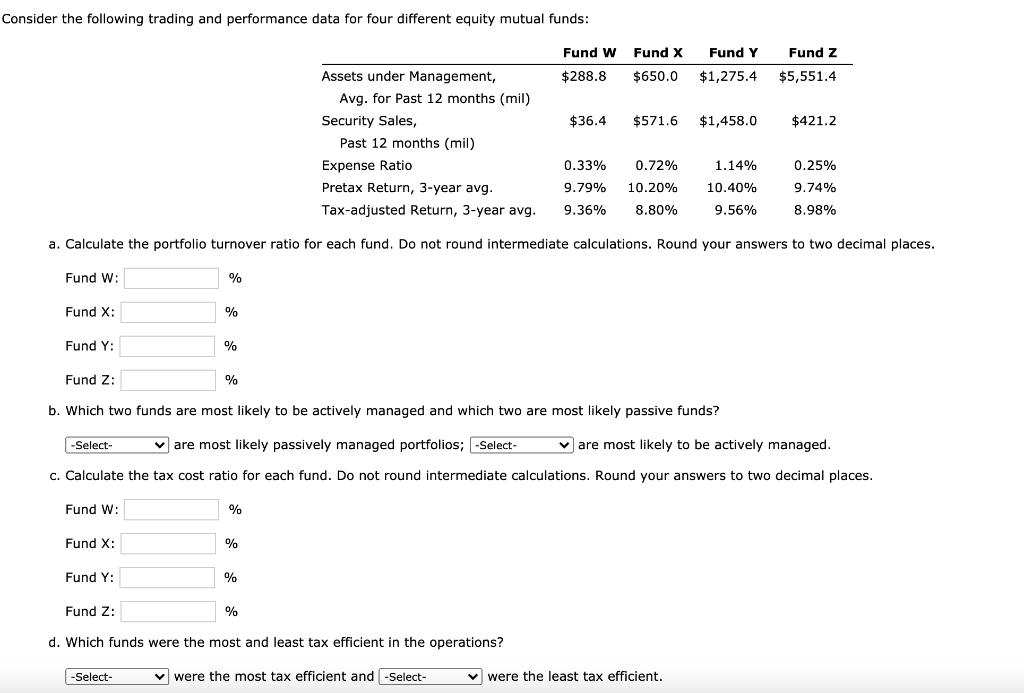

Question: Consider the following trading and performance data for four different equity mutual funds: Fund W Fund X Fund Y Fund z $288.8 $650.0 $1,275.4 $5,551.4

Consider the following trading and performance data for four different equity mutual funds: Fund W Fund X Fund Y Fund z $288.8 $650.0 $1,275.4 $5,551.4 $36.4 $571.6 $1,458.0 $421.2 Assets under Management, Avg. for Past 12 months (mil) Security Sales, Past 12 months (mil) Expense Ratio Pretax Return, 3-year avg. Tax-adjusted Return, 3-year avg. 0.33% 9.79% 9.36% 0.72% 10.20% 8.80% 1.14% 10.40% 9.56% 0.25% 9.74% 8.98% a. Calculate the portfolio turnover ratio for each fund. Do not round intermediate calculations. Round your answers to two decimal places. Fund W: % Fund X: % Fund Y: % Fund Z: % b. Which two funds are most likely to be actively managed and which two are most likely passive funds? -Select are most likely passively managed portfolios; -Select- are most likely to be actively managed. c. Calculate the tax cost ratio for each fund. Do not round intermediate calculations. Round your answers to two decimal places. Fund W: % Fund X: % Fund Y: % Fund Z: % d. Which funds were the most and least tax efficient in the operations? -Select- were the most tax efficient and -Select- were the least tax efficient

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts