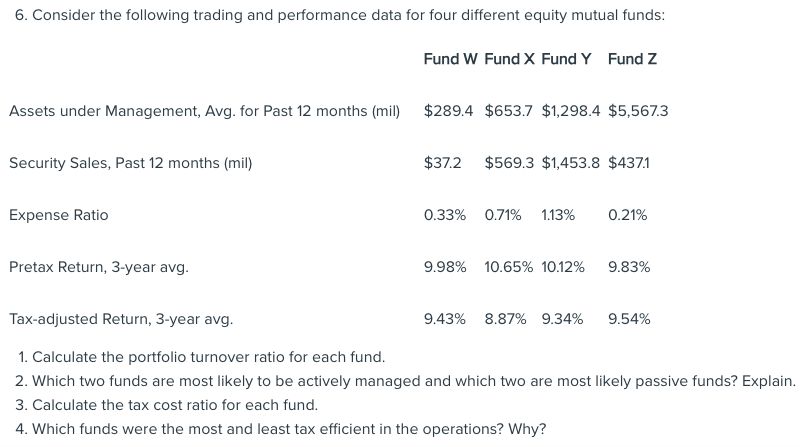

Question: Consider the following trading and performance data for four different equity mutual funds: Fund W Fund x Fund Y Fund Z Assets under Management, Avg.

Consider the following trading and performance data for four different equity mutual funds:

Fund Fund Fund Fund

Assets under Management, Avg. for Past months mil $ $ $ $

Security Sales, Past months mil

$$$$

Expense Ratio

Pretax Return, year avg.

Taxadjusted Return, year avg.

Calculate the portfolio turnover ratio for each fund.

Which two funds are most likely to be actively managed and which two are most likely passive funds? Explain.

Calculate the tax cost ratio for each fund.

Which funds were the most and least tax efficient in the operations? Why?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock