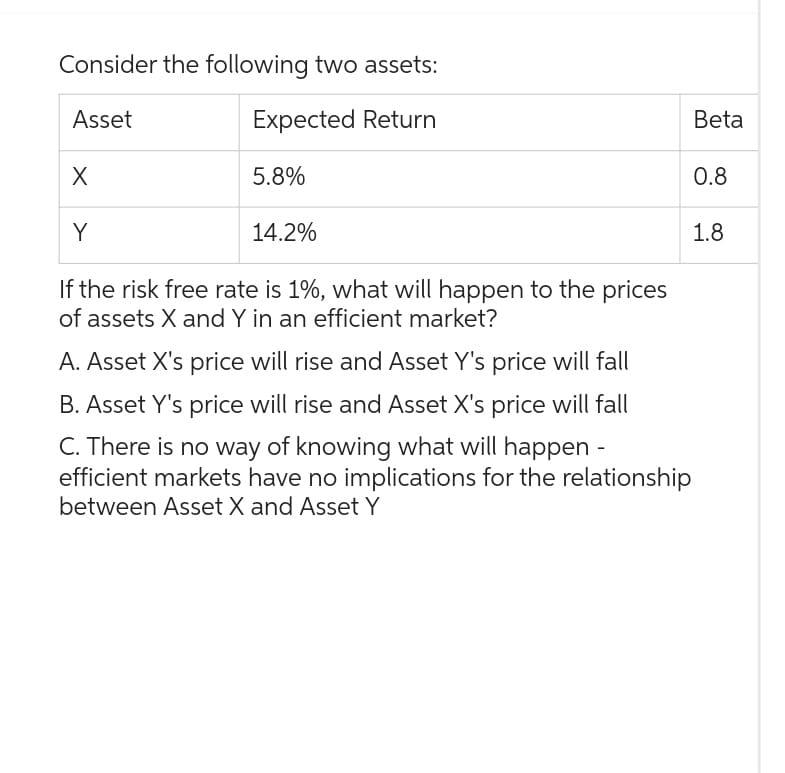

Question: Consider the following two assets: Asset Expected Return X Y 5.8% 14.2% If the risk free rate is 1%, what will happen to the

Consider the following two assets: Asset Expected Return X Y 5.8% 14.2% If the risk free rate is 1%, what will happen to the prices of assets X and Y in an efficient market? A. Asset X's price will rise and Asset Y's price will fall B. Asset Y's price will rise and Asset X's price will fall C. There is no way of knowing what will happen - efficient markets have no implications for the relationship between Asset X and Asset Y Beta 0.8 1.8

Step by Step Solution

3.55 Rating (165 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below Answer B Asset Y... View full answer

Get step-by-step solutions from verified subject matter experts