Question: ?? Consider the following two bonds with the same yield-to-maturity (YTM) of 6%: Bond A is a 15-year, 25% coupon bond, and bond B is

??

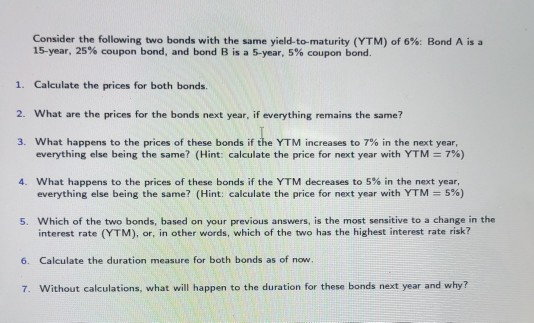

Consider the following two bonds with the same yield-to-maturity (YTM) of 6%: Bond A is a 15-year, 25% coupon bond, and bond B is a 5-year, 5% coupon bond. 1. Calculate the prices for both bonds. 2. What are the prices for the bonds next year, if everything remains the same? 3. What happens to the prices of these bonds if the YTM increases to 7% in the next year, everything else being the same? (Hint: calculate the price for next year with YTM = 7%) 4. What happens to the prices of these bonds if the YTM decreases to 5% in the next year, everything else being the same? (Hint: calculate the price for next year with YTM = 5%) 5. Which of the two bonds, based on your previous answers, is the most sensitive to a change in the interest rate (YTM), or, in other words, which of the two has the highest interest rate risk? 6. Calculate the duration measure for both bonds as of now 7. Without calculations, what will happen to the duration for these bonds next year and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts