Question: Consider the following two models for evaluating the performance of PPTRX: 1. One factor model with respect to S&P 500 returns. 2. Two factor

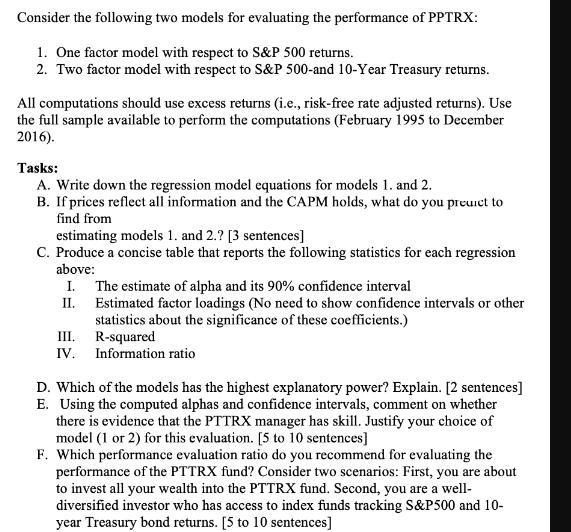

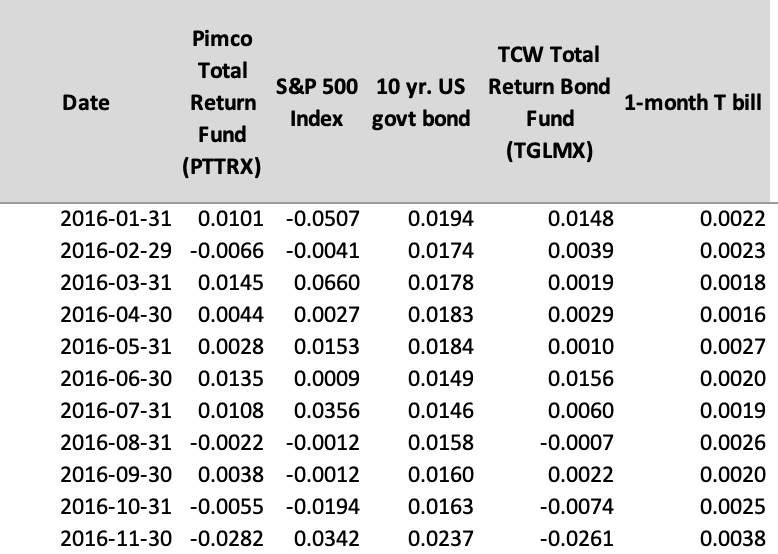

Consider the following two models for evaluating the performance of PPTRX: 1. One factor model with respect to S&P 500 returns. 2. Two factor model with respect to S&P 500-and 10-Year Treasury returns. All computations should use excess returns (i.e., risk-free rate adjusted returns). Use the full sample available to perform the computations (February 1995 to December 2016). Tasks: A. Write down the regression model equations for models 1. and 2. B. If prices reflect all information and the CAPM holds, what do you preuict to find from estimating models 1. and 2.? [3 sentences] C. Produce a concise table that reports the following statistics for each regression above: The estimate of alpha and its 90% confidence interval Estimated factor loadings (No need to show confidence intervals or other statistics about the significance of these coefficients.) III. R-squared IV. I. II. Information ratio D. Which of the models has the highest explanatory power? Explain. [2 sentences] E. Using the computed alphas and confidence intervals, comment on whether there is evidence that the PTTRX manager has skill. Justify your choice of model (1 or 2) for this evaluation. [5 to 10 sentences] F. Which performance evaluation ratio do you recommend for evaluating the performance of the PTTRX fund? Consider two scenarios: First, you are about to invest all your wealth into the PTTRX fund. Second, you are a well- diversified investor who has access to index funds tracking S&P500 and 10- year Treasury bond returns. [5 to 10 sentences] Date Pimco Total Return Fund (PTTRX) S&P 500 10 yr. US Index govt bond 2016-01-31 0.0101 -0.0507 0.0194 2016-02-29 -0.0066 -0.0041 0.0174 2016-03-31 0.0145 0.0660 0.0178 2016-04-30 0.0044 0.0027 0.0183 0.0184 0.0149 2016-05-31 0.0028 0.0153 2016-06-30 0.0135 0.0009 2016-07-31 0.0108 0.0356 2016-08-31 -0.0022 -0.0012 0.0146 0.0158 2016-09-30 0.0038 -0.0012 0.0160 2016-10-31 -0.0055 -0.0194 0.0163 2016-11-30 -0.0282 0.0342 0.0237 TCW Total Return Bond Fund (TGLMX) 0.0148 0.0039 0.0019 0.0029 0.0010 0.0156 0.0060 -0.0007 0.0022 -0.0074 -0.0261 1-month T bill 0.0022 0.0023 0.0018 0.0016 0.0027 0.0020 0.0019 0.0026 0.0020 0.0025 0.0038

Step by Step Solution

3.56 Rating (153 Votes )

There are 3 Steps involved in it

A Regression model equations for models 1 and 2 One factor model with respect to SP 500 returns PPTRX Excess Return SP 500 Excess Return Error Two factor model with respect to SP 500 and 10Year Treasu... View full answer

Get step-by-step solutions from verified subject matter experts