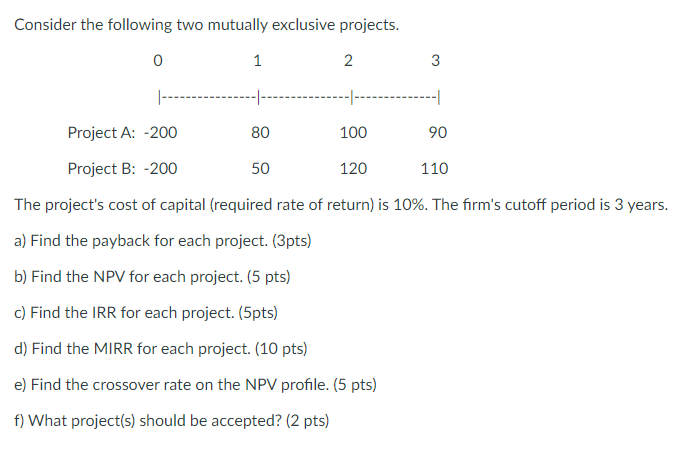

Question: Consider the following two mutually exclusive projects. 0 1 2 3 -1. -- Project A: -200 80 100 90 Project B: -200 50 120 110

Consider the following two mutually exclusive projects. 0 1 2 3 -1. -- Project A: -200 80 100 90 Project B: -200 50 120 110 The project's cost of capital (required rate of return) is 10%. The firm's cutoff period is 3 years. a) Find the payback for each project. (3pts) b) Find the NPV for each project. (5 pts) c) Find the IRR for each project. (5pts) d) Find the MIRR for each project. (10 pts) e) Find the crossover rate on the NPV profile. (5 pts) f) What project(s) should be accepted? (2 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts