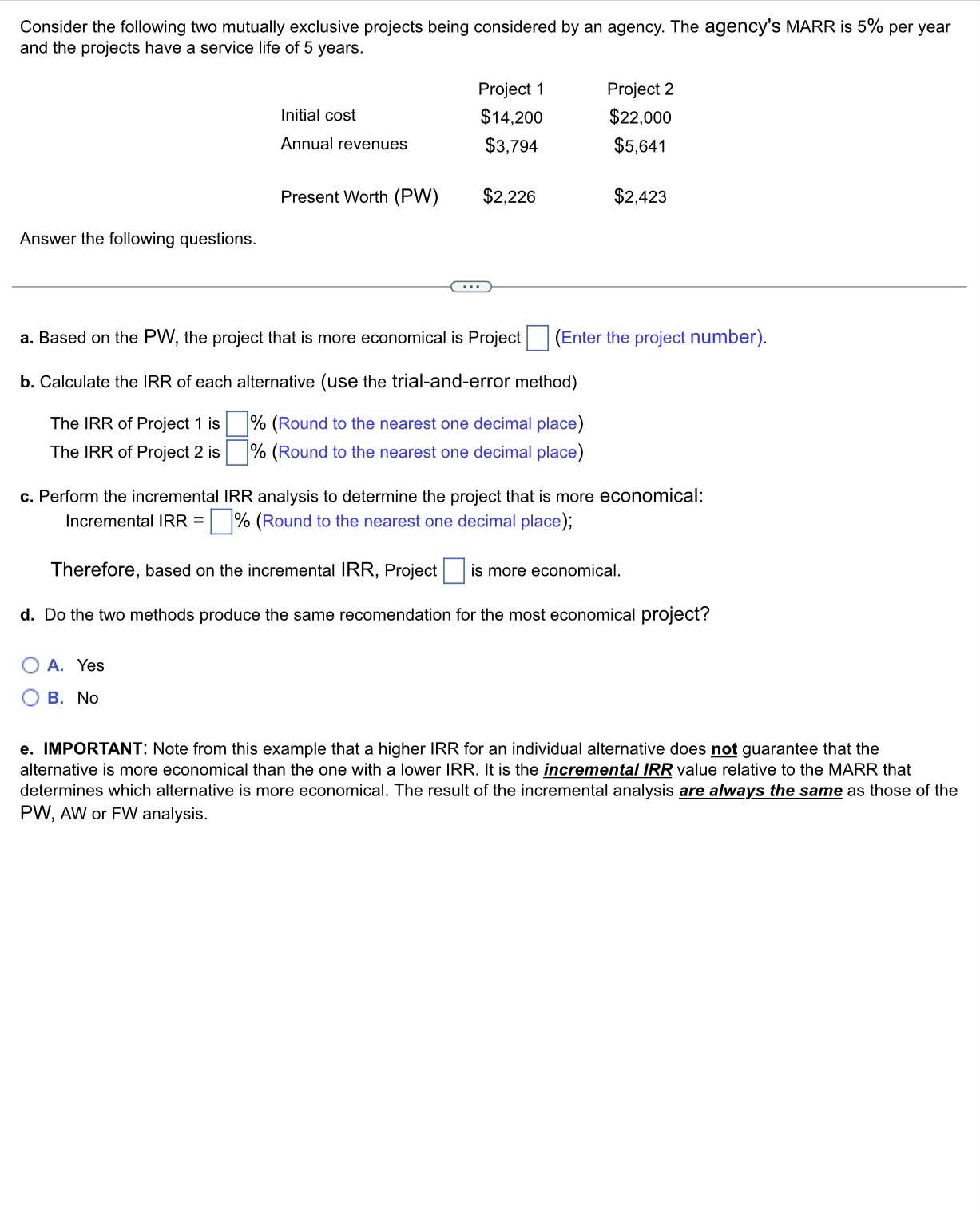

Question: Consider the following two mutually exclusive projects being considered by an agency. The agency's MARR is 5% per year and the projects have a service

Consider the following two mutually exclusive projects being considered by an agency. The agency's MARR is 5% per year and the projects have a service life of 5 years. Project 1 Project 2 Initial cost $14,200 $22,000 Annual revenues $3,794 $5_541 Present Worth (PW) $2,226 $2,423 Answer the following questions. E} a. Based on the PW, the project that is more economical is Project |:] (Enter the project number). b. Calculate the IRR of each alternative (use the trial-and-error method) The IRR of Project 1 is |:|% (Round to the nearest one decimal place) The IRR of Project 2 is |:|% (Round to the nearest one decimal place) c. Perform the incremental IRR analysis to determine the project that is more economical: Incremental IRR = _1% (Round to the nearest one decimal place); Therefore. based on the incremental IRR, Project D is more economical. cl. Do the two methods produce the same recomendation for the most economical project? C? A. Yes (:9 B. No e. IMPORTANT: Note from this example that a higher IRR for an individual alternative does n_ot guarantee that the alternative is more economical than the one with a lower IRR. It is the incremental IRR value relative to the MARR that determines which alternative is more economical. The result of the incremental analysis are always the same as those of the PW, AW or FW analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts