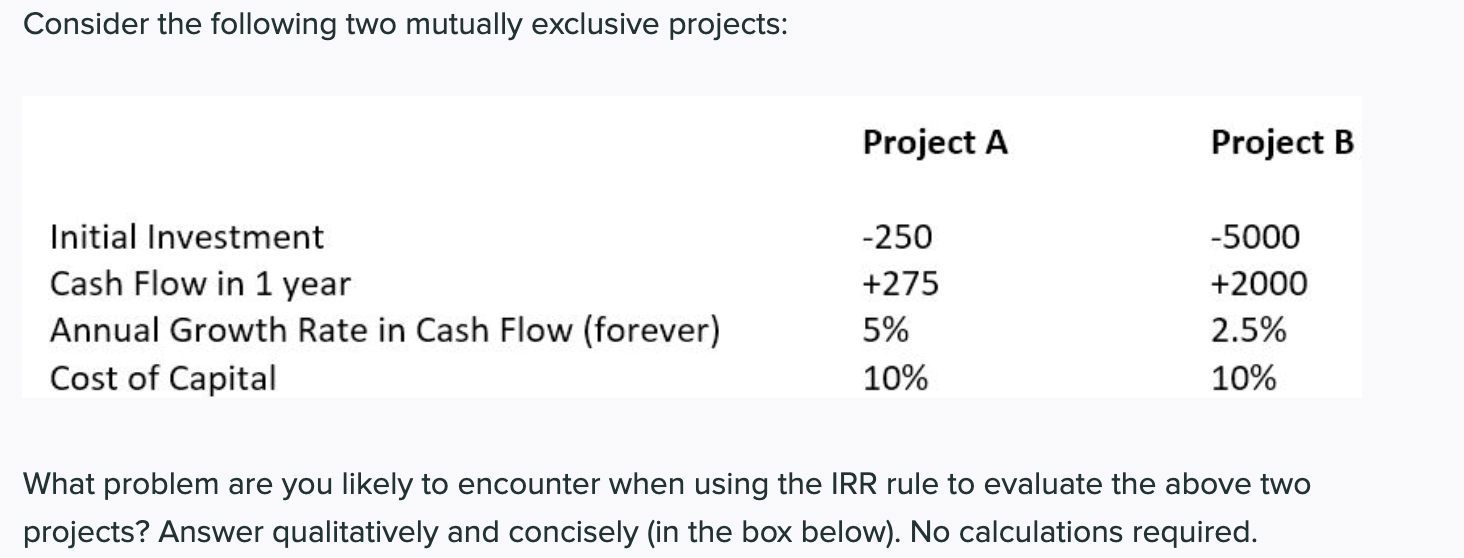

Question: Consider the following two mutually exclusive projects: Project A Project B Initial Investment Cash Flow in 1 year Annual Growth Rate in Cash Flow (forever)

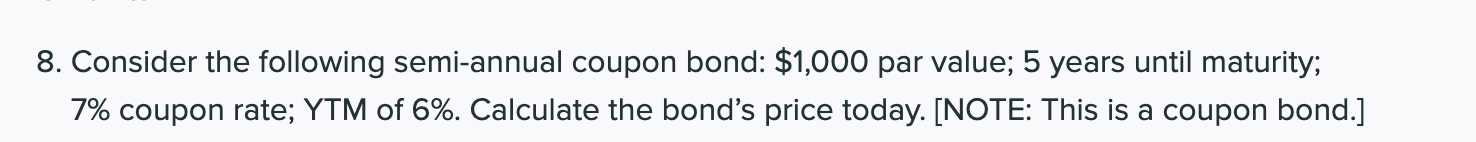

Consider the following two mutually exclusive projects: Project A Project B Initial Investment Cash Flow in 1 year Annual Growth Rate in Cash Flow (forever) Cost of Capital -250 +275 5% 10% -5000 +2000 2.5% 10% What problem are you likely to encounter when using the IRR rule to evaluate the above two projects? Answer qualitatively and concisely (in the box below). No calculations required. 8. Consider the following semi-annual coupon bond: $1,000 par value; 5 years until maturity; 7% coupon rate; YTM of 6%. Calculate the bond's price today. [NOTE: This is a coupon bond.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts