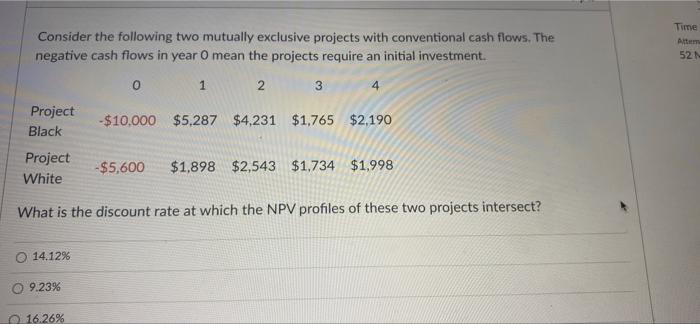

Question: Consider the following two mutually exclusive projects with conventional cash flows. The negative cash flows in year O mean the projects require an initial

Consider the following two mutually exclusive projects with conventional cash flows. The negative cash flows in year O mean the projects require an initial investment. 0 1 2 3 4 Project Black -$10,000 $5,287 $4,231 $1,765 $2,190 Project -$5,600 $1,898 $2,543 $1,734 $1,998 White What is the discount rate at which the NPV profiles of these two projects intersect? O 14.12% 9.23% 16.26 % Time Attem 52 M

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Solution Discount Rate 1412 Project Black Year Cash Flow Discounting factor Present Value 10000 1000... View full answer

Get step-by-step solutions from verified subject matter experts