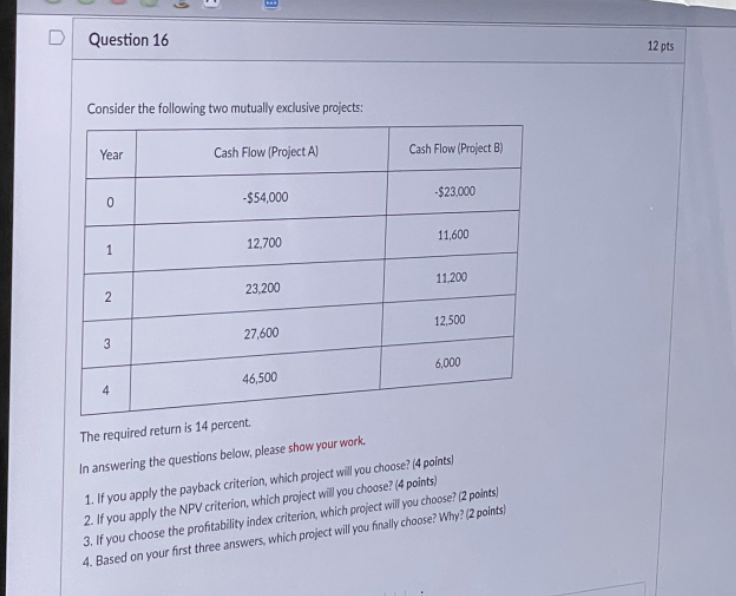

Question: Consider the following two mutually exclusive projects: Year Cash Flow (Project A) Cash Flow (Project B) -$54,000 1 2 3 12.700 23,200 27,600 -$23,000 11.600

Consider the following two mutually exclusive projects: Year Cash Flow (Project A) Cash Flow (Project B) -$54,000 1 2 3 12.700 23,200 27,600 -$23,000 11.600 11,200 12,500 6.000 46,500 The required return is 14 percent. In answering the questions below, please show your work. 1. If you apply the payback criterion, which project will you choose? (4 points) 2. If you apply the NPV criterion, which project will you choose? (4 points) 3. If you choose the profitability index criterion, which project will you choose? (2 points) 4. Based on your first three answers, which project will you finally choose? Why? (2 points)

D Question 16 Consider the following two mutually exclusive projects: Year Cash Flow (Project A) 0 -$54,000 12,700 23,200 27,600 1 2 B 3 Cash Flow (Project B) -$23,000 11,600 11.200 12,500 4 46,500 6,000 The required return is 14 percent. In answering the questions below, please show your work. 1. If you apply the payback criterion, which project will you choose? (4 points) 2. If you apply the NPV criterion, which project will you choose? (4 points) 3. If you choose the profitability index criterion, which project will you choose? (2 points) 4. Based on your first three answers, which project will you finally choose? Why? (2 points) 12 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts