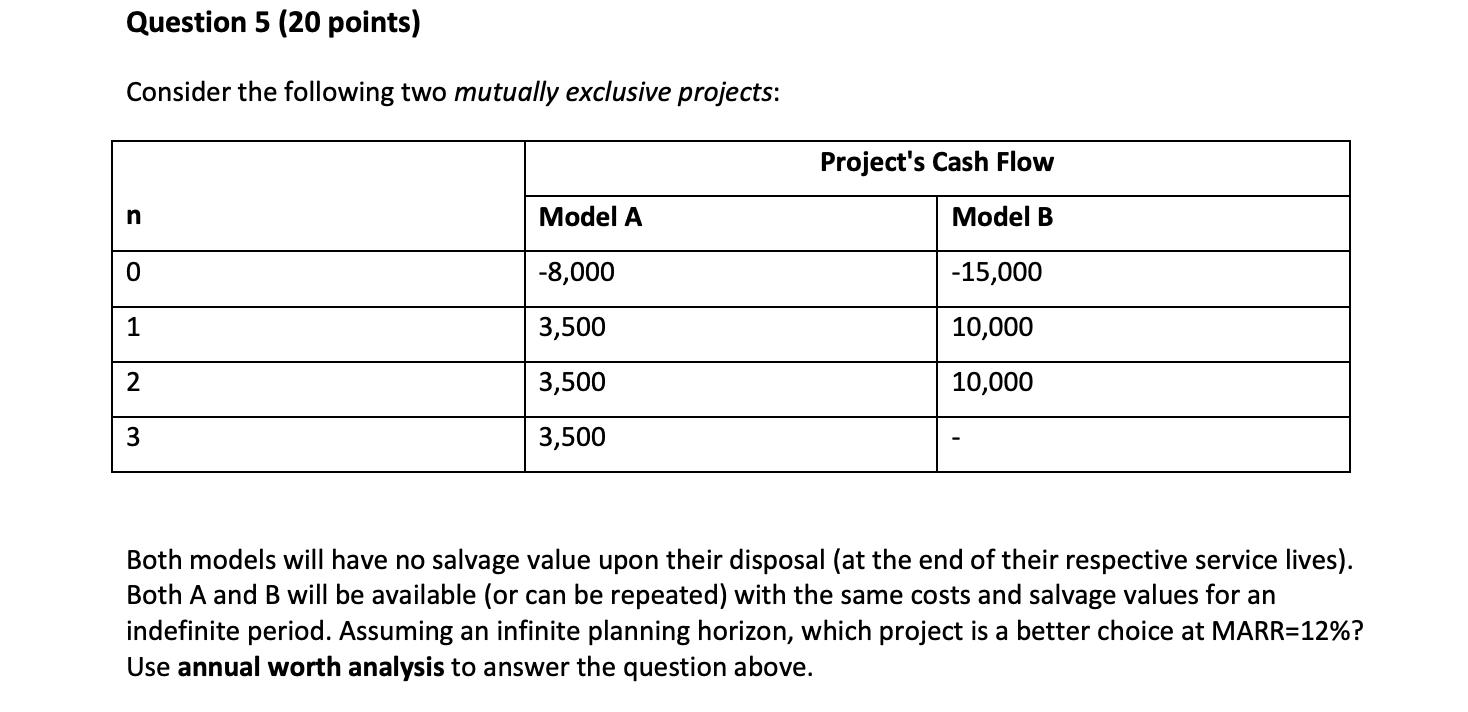

Question: Consider the following two mutually exclusive projects:nProject's Cash FlowModel A Model B0 -8,000 -15,0001 3,500 10,0002 3,500 10,0003 3,500 -Both models will have no salvage

Consider the following two mutually exclusive projects:nProject's Cash FlowModel A Model B0 -8,000 -15,0001 3,500 10,0002 3,500 10,0003 3,500 -Both models will have no salvage value upon their disposal (at the end of their respective service lives).Both A and B will be available (or can be repeated) with the same costs and salvage values for anindefinite period. Assuming an infinite planning horizon, which project is a better choice at MARR=12%?Use annual worth analysis to answer the question above.

Question 5 (20 points) Consider the following two mutually exclusive projects: Project's Cash Flow n Model A Model B -8,000 -15,000 1 3,500 10,000 3,500 10,000 3,500 Both models will have no salvage value upon their disposal (at the end of their respective service lives). Both A and B will be available (or can be repeated) with the same costs and salvage values for an indefinite period. Assuming an infinite planning horizon, which project is a better choice at MARR=12%? Use annual worth analysis to answer the question above. 2.

Step by Step Solution

There are 3 Steps involved in it

To determine which project is better using annual worth analysis we first need to convert the net pr... View full answer

Get step-by-step solutions from verified subject matter experts