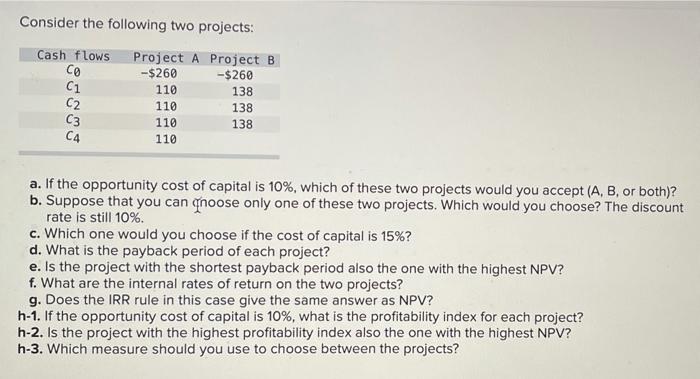

Question: Consider the following two projects: Cash flows CO C1 C2 C3 C4 Project A Project B -$260 -$260 110 138 110 138 110 138 110

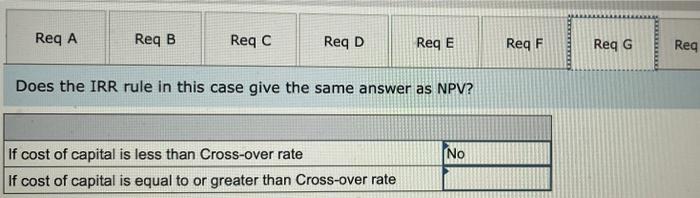

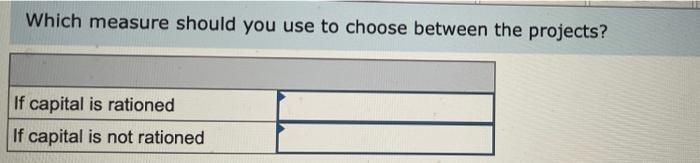

Consider the following two projects: Cash flows CO C1 C2 C3 C4 Project A Project B -$260 -$260 110 138 110 138 110 138 110 a. If the opportunity cost of capital is 10%, which of these two projects would you accept (A, B, or both)? b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 10%. c. Which one would you choose if the cost of capital is 15%? d. What is the payback period of each project? e. Is the project with the shortest payback period also the one with the highest NPV? f. What are the internal rates of return on the two projects? g. Does the IRR rule in this case give the same answer as NPV? h-1. If the opportunity cost of capital is 10%, what is the profitability index for each project? h-2. Is the project with the highest profitability index also the one with the highest NPV? h-3. Which measure should you use to choose between the projects? Req A Req B Reqc Req D Reg E ReqF Req G Req Does the IRR rule in this case give the same answer as NPV? No If cost of capital is less than Cross-over rate If cost of capital is equal to or greater than Cross-over rate Which measure should you use to choose between the projects? If capital is rationed If capital is not rationed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts