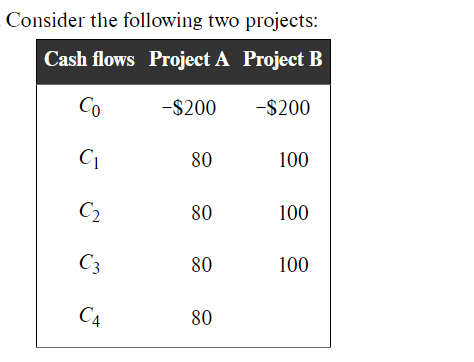

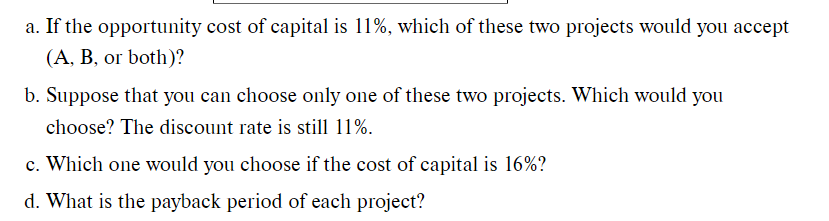

Question: Consider the following two projects: Cash flows Project A Project B Co -$200 -$200 C1 80 100 C2 80 100 C3 80 100 C4 80

Consider the following two projects: Cash flows Project A Project B Co -$200 -$200 C1 80 100 C2 80 100 C3 80 100 C4 80 a. If the opportunity cost of capital is 11%, which of these two projects would you accept (A, B, or both)? b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 11%. c. Which one would you choose if the cost of capital is 16%? d. What is the payback period of each project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts