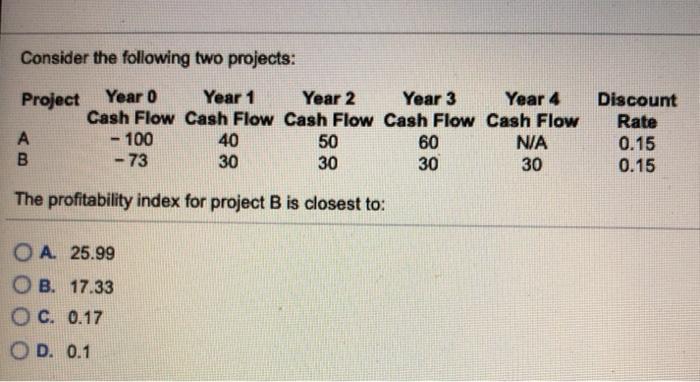

Question: Consider the following two projects: Project Year 0 Year 1 Year 2 Year 3 Year 4 Cash Flow Cash Flow Cash Flow Cash Flow Cash

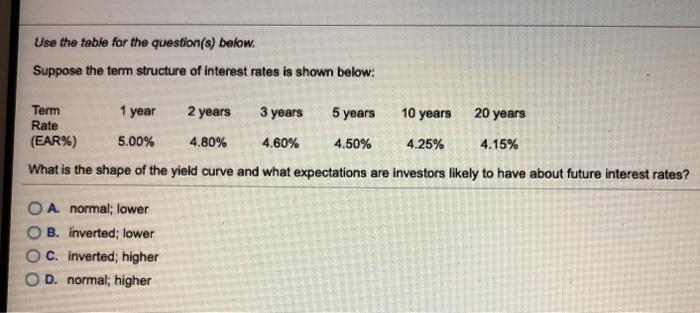

Consider the following two projects: Project Year 0 Year 1 Year 2 Year 3 Year 4 Cash Flow Cash Flow Cash Flow Cash Flow Cash Flow A - 100 50 60 NA B -73 30 30 30 30 40 Discount Rate 0.15 0.15 The profitability index for project B is closest to: O A. 25.99 B. 17.33 OC. 0.17 D. 0.1 Use the table for the question(s) below. Suppose the term structure of interest rates is shown below: Term 1 year 2 years 3 years 5 years 10 years 20 years Rate (EAR%) 5.00% 4.80% 4.60% 4.50% 4.25% 4.15% What is the shape of the yield curve and what expectations are investors likely to have about future interest rates? O A. normal; lower B. inverted; lower C. Inverted; higher OD. normal; higher

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts