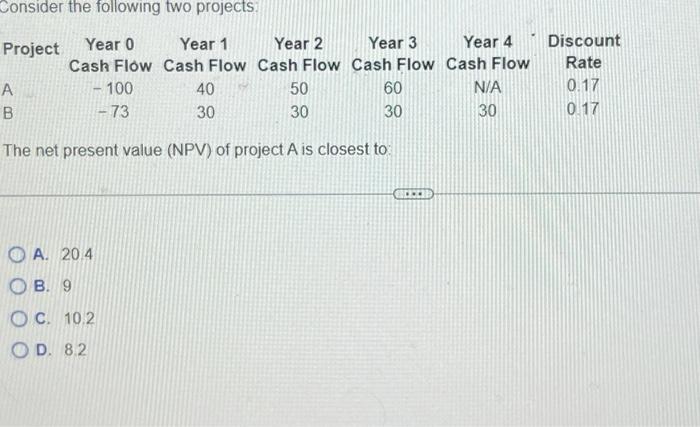

Question: Consider the following two projects Project Year o Year 1 Year 2 Year 3 Year 4 Cash Flow Cash Flow Cash Flow Cash Flow Cash

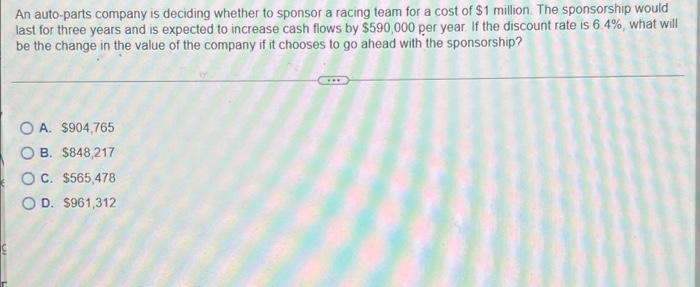

Consider the following two projects Project Year o Year 1 Year 2 Year 3 Year 4 Cash Flow Cash Flow Cash Flow Cash Flow Cash Flow A - 100 50 N/A . - 73 30 30 30 Discount Rate 0.17 0.17 60 40 30 The net present value (NPV) of project A is closest to OA. 204 OB. 9 OC 10.2 OD. 82 An auto parts company is deciding whether to sponsor a racing team for a cost of $1 million The sponsorship would last for three years and is expected to increase cash flows by $590,000 per year. If the discount rate is 6 4%, what will be the change in the value of the company if it chooses to go ahead with the sponsorship? O A. $904,765 B. $848,217 C. $565,478 OD. $961, 312

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts