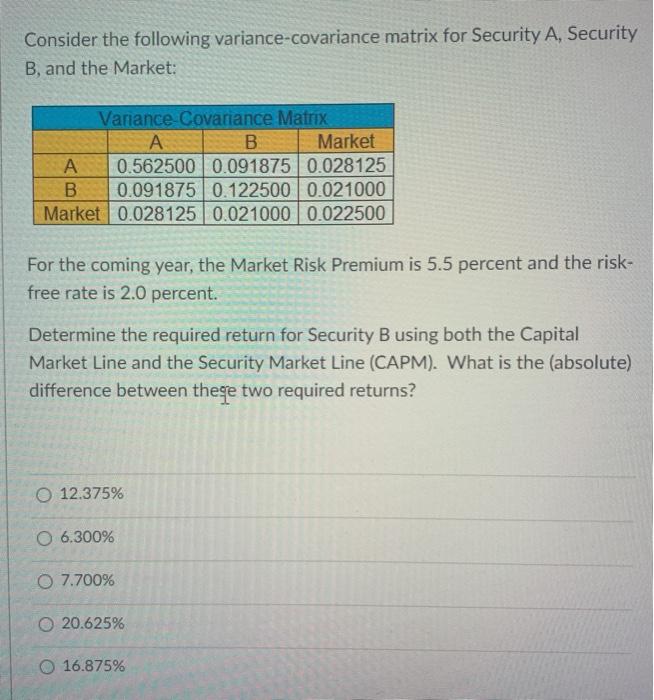

Question: Consider the following variance-covariance matrix for Security A, Security B, and the Market: Variance Covariance Matrix B Market A 0.562500 | 0.091875 0.028125 B 0.091875

Consider the following variance-covariance matrix for Security A, Security B, and the Market: Variance Covariance Matrix B Market A 0.562500 | 0.091875 0.028125 B 0.091875 0.122500 0.021000 Market 0.028125 0.021000 0.022500 For the coming year, the Market Risk Premium is 5.5 percent and the risk- free rate is 2.0 percent. Determine the required return for Security B using both the Capital Market Line and the Security Market Line (CAPM). What is the (absolute) difference between theqe two required returns? O 12.375% O 6.300% 0 7.700% 0 20.625% O 16.875%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock