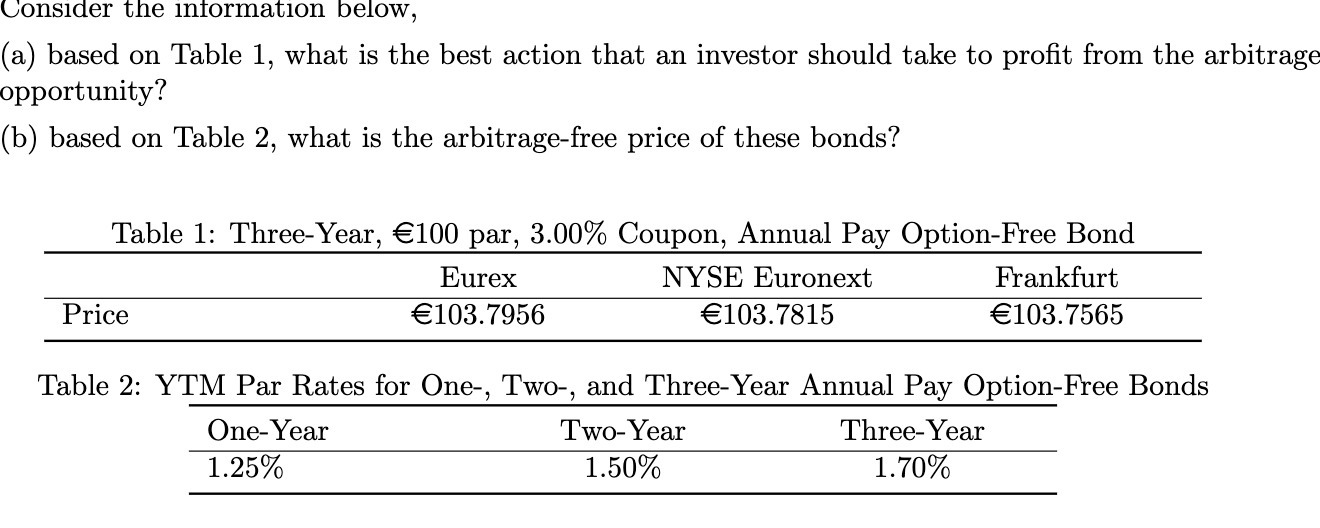

Question: Consider the information below, (a) based on Table 1, what is the best action that an investor should take to profit from the arbitrage opportunity?

Consider the information below, (a) based on Table 1, what is the best action that an investor should take to profit from the arbitrage opportunity? (b) based on Table 2, what is the arbitrage-free price of these bonds? Table 1: Three-Year, E100 par, 3.00% Coupon, Annual Pay Option-Free Bond Eurex NYSE Euronext Frankfurt Price (103.7956 (103.7815 E103.7565 Table 2: YTM Par Rates for One-, Two-, and Three-Year Annual Pay Option-Free Bonds One-Year Two-Year Three-Year 1.25% 1.50% 1.70%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts