Question: Consider the interest rate tree in Table 9.9. (a) Compute the expected 6-month Treasury rate E[r1 ]. (b) The 1-year Treasury bill is trading at

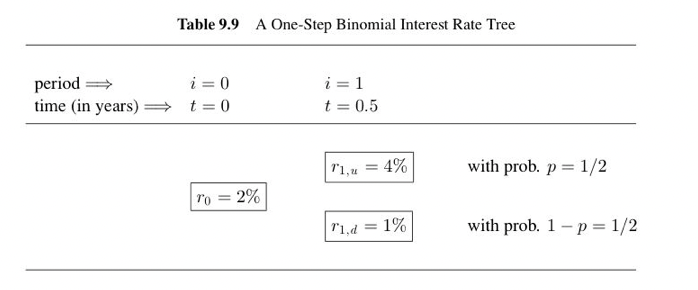

Consider the interest rate tree in Table 9.9. (a) Compute the expected 6-month Treasury rate E[r1 ]. (b) The 1-year Treasury bill is trading at P0 (2) = 97.4845. What is the (continu- ously compounded) forward rate for the periods i = 1 to i = 2? How does it compare with the expected rate computed in Part (a)? Explain. (c) Compute the market price of risk . Interpret. (d) Compute the risk neutral probability p . Interpret.

Table 9.9 A One-Step Binomial Interest Rate Tree period i=0 time (in years) t= 0 i=1 t=0.5 71,4 = 4% with prob. p = 1/2 To = 2% r.d = 1% with prob. 1-p= 1/2 Table 9.9 A One-Step Binomial Interest Rate Tree period i=0 time (in years) t= 0 i=1 t=0.5 71,4 = 4% with prob. p = 1/2 To = 2% r.d = 1% with prob. 1-p= 1/2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts