Question: Consider the intertemporal consumption choice when in period ta consumer faces a sequence of expected incomes y, yetu y that are exogenous to the

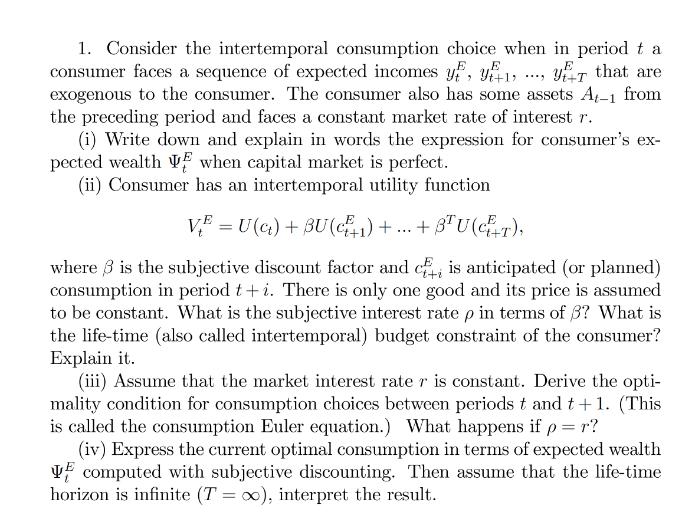

Consider the intertemporal consumption choice when in period ta consumer faces a sequence of expected incomes y, yetu y that are exogenous to the consumer. The consumer also has some assets A-1 from the preceding period and faces a constant market rate of interest r. (i) Write down and explain in words the expression for consumer's ex- pected wealth when capital market is perfect. (ii) Consumer has an intertemporal utility function VE E = U(c) + BU(+1) + ... +3U (CT), where is the subjective discount factor and c, is anticipated (or planned) consumption in period t+i. There is only one good and its price is assumed to be constant. What is the subjective interest rate p in terms of 3? What is the life-time (also called intertemporal) budget constraint of the consumer? Explain it. (iii) Assume that the market interest rate r is constant. Derive the opti- mality condition for consumption choices between periods t and t+1. (This is called the consumption Euler equation.) What happens if p = r? (iv) Express the current optimal consumption in terms of expected wealth computed with subjective discounting. Then assume that the life-time horizon is infinite (T= ), interpret the result.

Step by Step Solution

There are 3 Steps involved in it

The detailed ... View full answer

Get step-by-step solutions from verified subject matter experts