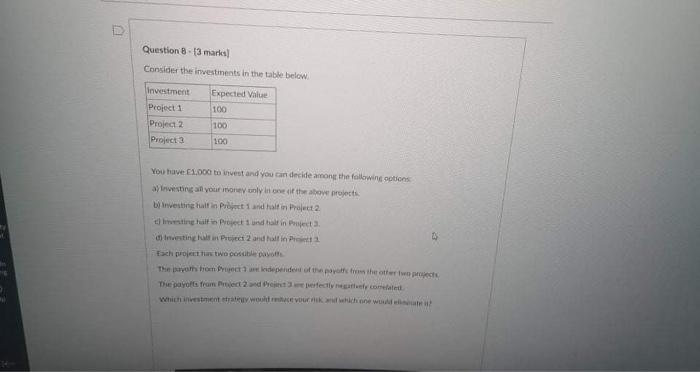

Question: Consider the investments below: project 1 : expected value 100 project 2 : expected value 100 project 3 : expected value 100 You have 1000

Question 8 - 13 marks Consider the investments in the table below Expected Value 100 investment Project 1 Project 2 Project 100 100 You have 1,000 to invest and you can decide among the following options a investing all your money only in one of the above projects investing half in Proct 1 andhaltin Project 2 thing lifi Project and all in Preta Investing in Project 2 and all in The worstom Prindependent of the parts from the otter in pect The payoffs from Project and tested content

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts