Question: Consider the JDW Investment Strategy case problem that was first discussed in tutorials in Week 8 and then reviewed in class in Week 9. What

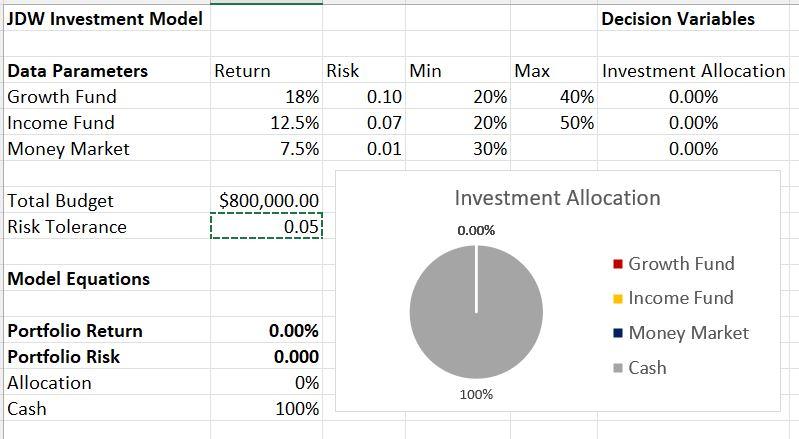

Consider the "JDW Investment Strategy" case problem that was first discussed in tutorials in Week 8 and then reviewed in class in Week 9. What is the optimal portfolio return for a maximum risk tolerance of 0.0490. Report this return as a percentage using four decimals (e.g., for an optimal return of 12.3456%, enter 12.3456). Your Answer: Answer Hide hint for Question 9 Use the JDW Spreadsheet Model from Lecture 7 JDW Investment Model Decision Variables Data Parameters Growth Fund Income Fund Money Market Return Risk Min 18% 0.10 12.5% 0.07 7.5% 0.01 Max Investment Allocation 20% 40% 0.00% 20% 50% 0.00% 30% 0.00% Investment Allocation Total Budget Risk Tolerance $800,000.00 0.05 0.00% Model Equations 0 Growth Fund Income Fund - Money Market Cash Portfolio Return Portfolio Risk Allocation Cash 0.00% 0.000 0% 100% 100% Consider the "JDW Investment Strategy" case problem that was first discussed in tutorials in Week 8 and then reviewed in class in Week 9. What is the optimal portfolio return for a maximum risk tolerance of 0.0490. Report this return as a percentage using four decimals (e.g., for an optimal return of 12.3456%, enter 12.3456). Your Answer: Answer Hide hint for Question 9 Use the JDW Spreadsheet Model from Lecture 7 JDW Investment Model Decision Variables Data Parameters Growth Fund Income Fund Money Market Return Risk Min 18% 0.10 12.5% 0.07 7.5% 0.01 Max Investment Allocation 20% 40% 0.00% 20% 50% 0.00% 30% 0.00% Investment Allocation Total Budget Risk Tolerance $800,000.00 0.05 0.00% Model Equations 0 Growth Fund Income Fund - Money Market Cash Portfolio Return Portfolio Risk Allocation Cash 0.00% 0.000 0% 100% 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts