Question: Consider the Key Rates model with keys equal to 2, 5, 10, and 30 year forward rates. Assume that currently all forward interest rates

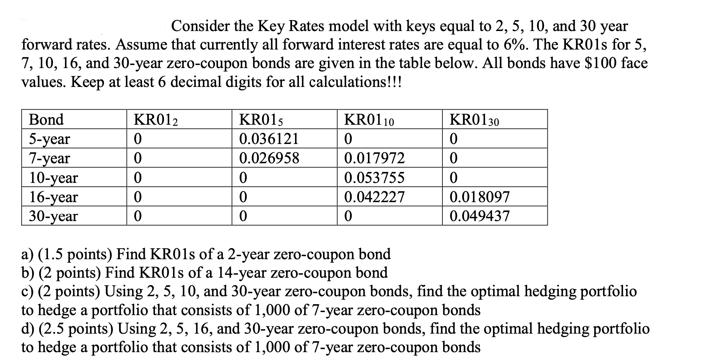

Consider the Key Rates model with keys equal to 2, 5, 10, and 30 year forward rates. Assume that currently all forward interest rates are equal to 6%. The KRO1s for 5, 7, 10, 16, and 30-year zero-coupon bonds are given in the table below. All bonds have $100 face values. Keep at least 6 decimal digits for all calculations!!! Bond 5-year 7-year 10-year 16-year 30-year KR012 0 0 0 0 0 KRO1s 0.036121 0.026958 0 0 0 KR01 10 0 0.017972 0.053755 0.042227 0 KR0130 0 0 0 0.018097 0.049437 a) (1.5 points) Find KR01s of a 2-year zero-coupon bond b) (2 points) Find KR01s of a 14-year zero-coupon bond c) (2 points) Using 2, 5, 10, and 30-year zero-coupon bonds, find the optimal hedging portfolio to hedge a portfolio that consists of 1,000 of 7-year zero-coupon bonds d) (2.5 points) Using 2, 5, 16, and 30-year zero-coupon bonds, find the optimal hedging portfolio to hedge a portfolio that consists of 1,000 of 7-year zero-coupon bonds

Step by Step Solution

There are 3 Steps involved in it

a To find KR01s of a 2year zerocoupon bond we need to find the sensitivity of the bonds price to a 1 basis point change in the 2year forward rate Sinc... View full answer

Get step-by-step solutions from verified subject matter experts