Question: Consider the merger arbitrage strategy that delivers positive average excess returns. Companies who announce a merger typically experience an upward jump in their stock price.

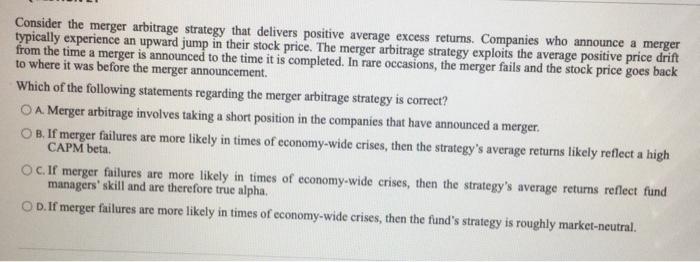

Consider the merger arbitrage strategy that delivers positive average excess returns. Companies who announce a merger typically experience an upward jump in their stock price. The merger arbitrage strategy exploits the average positive price drift from the time a merger is announced to the time it is completed. In rare occasions, the merger fails and the stock price goes back to where it was before the merger announcement. Which of the following statements regarding the merger arbitrage strategy is correct? O A Merger arbitrage involves taking a short position in the companies that have announced a merger. OB. If merger failures are more likely in times of economy-wide crises, then the strategy's average returns likely reflect a high CAPM beta Oc. If merger failures are more likely in times of economy-wide crises, then the strategy's average returns reflect fund managers' skill and are therefore true alpha. OD. If merger failures are more likely in times of economy-wide crises, then the fund's strategy is roughly market-neutral

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts