Question: Consider the Merton jump-diffusion asset model exp(X ) where Nt X. = Hut + OB. + > t2 0, Hw k=1 with the risk-neutral drift

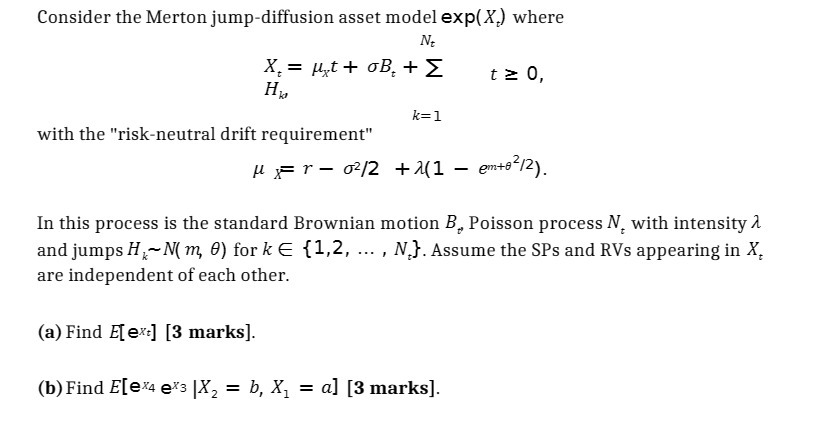

Consider the Merton jump-diffusion asset model exp(X ) where Nt X. = Hut + OB. + > t2 0, Hw k=1 with the "risk-neutral drift requirement" H=r - 02/2 + 1(1 - em+8212). In this process is the standard Brownian motion B. Poisson process N, with intensity and jumps H,~N( m, 0) for k E {1,2, ..., N.}. Assume the SPs and RVs appearing in X, are independent of each other. (a) Find E[ext] [3 marks]. (b) Find E[ex4 e*3 [X2 = b, X, = a] [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts