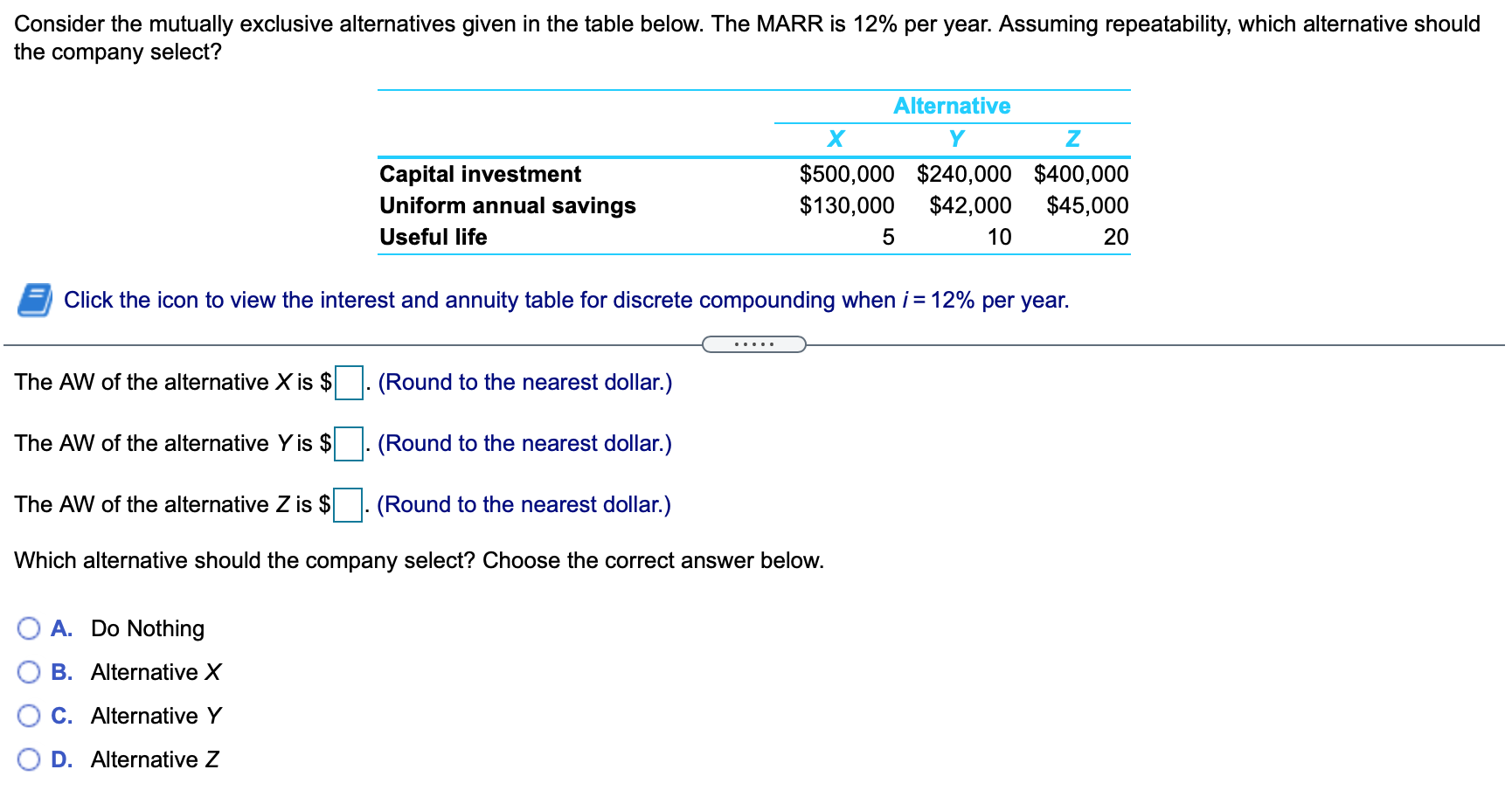

Question: Consider the mutually exclusive alternatives given in the table below. The MARR is 12% per year. Assuming repeatability, which alternative should the company select? Alternative

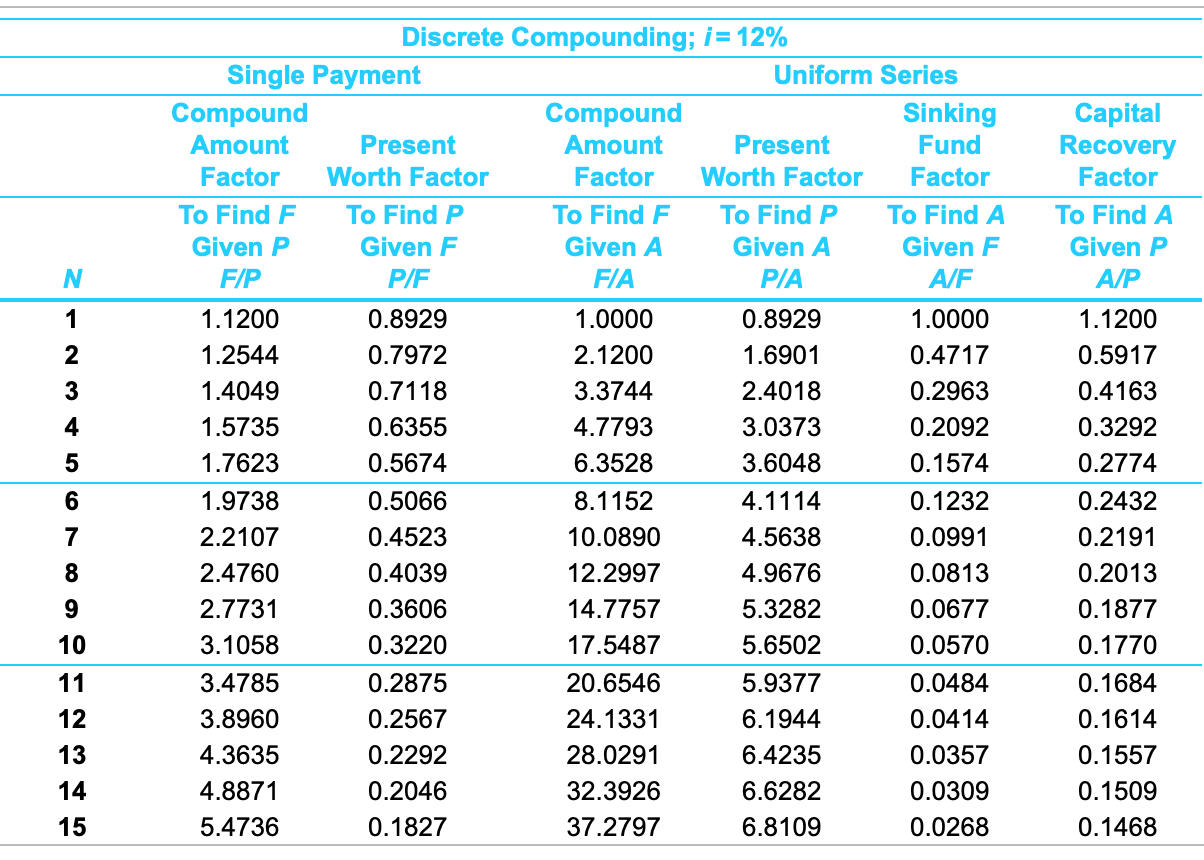

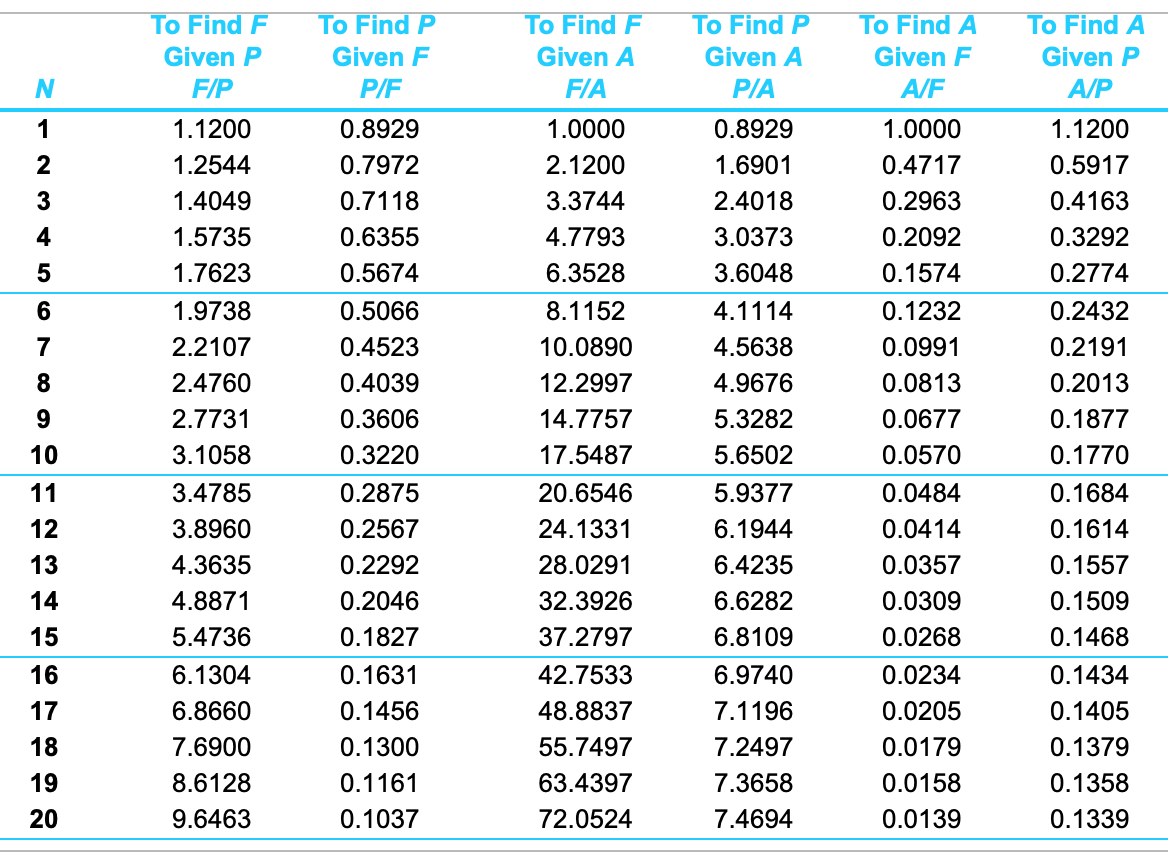

Consider the mutually exclusive alternatives given in the table below. The MARR is 12% per year. Assuming repeatability, which alternative should the company select? Alternative Y X Z Capital investment Uniform annual savings Useful life $500,000 $240,000 $400,000 $130,000 $42,000 $45,000 5 10 20 Click the icon to view the interest and annuity table for discrete compounding when i = 12% per year. The AW of the alternative X is $ (Round to the nearest dollar.) The AW of the alternative Y is $ (Round to the nearest dollar.) The AW of the alternative Z is $ (Round to the nearest dollar.) Which alternative should the company select? Choose the correct answer below. O A. Do Nothing B. Alternative X C. Alternative Y D. Alternative Z N 1 2 3 4 Discrete Compounding; i = 12% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F F/P. P/F FIA PIA A/F 1.1200 0.8929 1.0000 0.8929 1.0000 1.2544 0.7972 2.1200 1.6901 0.4717 1.4049 0.7118 3.3744 2.4018 0.2963 1.5735 0.6355 4.7793 3.0373 0.2092 0.5674 28 3.6048 0. 1.9738 0.5066 8.1152 4.1114 0.1232 2.2107 0.4523 10.0890 4.5638 0.0991 2.4760 0.4039 12.2997 4.9676 0.0813 2.7731 0.3606 14.7757 5.3282 0.0677 3.1058 0.3220 17.5487 5.6502 0.0570 3.4785 0.2875 20.6546 5.9377 0.0484 3.8960 0.2567 24.1331 6.1944 0.0414 4.3635 0.2292 28.0291 6.4235 0.0357 4.8871 0.2046 32.3926 6.6282 0.0309 5.4736 0.1827 37.2797 6.8109 0.0268 5 Capital Recovery Factor To Find A Given P A/P 1.1200 0.5917 0.4163 0.3292 0.2774 0.2432 0.2191 0.2013 0.1877 0.1770 0.1684 0.1614 0.1557 0.1509 0.1468 6 7 8 9 10 11 12 13 14 15 To Find P Given F P/F N 1 3 4 200 000 5 6 7 8 9 To Find F Given P F/P 1.1200 1.2544 1.4049 1.5735 1.7623 1.9738 2.2107 2.4760 2.7731 3.1058 3.4785 3.8960 4.3635 4.8871 5.4736 6.1304 6.8660 7.6900 8.6128 9.6463 To Find F Given A FIA 1.0000 2.1200 3.3744 4.7793 6.3528 8.1152 10.0890 12.2997 14.7757 17.5487 20.6546 24.1331 28.0291 32.3926 37.2797 42.7533 48.8837 55.7497 63.4397 72.0524 To Find P Given A PIA 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 4.5638 4.9676 5.3282 5.6502 5.9377 6.1944 6.4235 6.6282 6.8109 6.9740 7.1196 7.2497 7.3658 7.4694 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0.3220 0.2875 0.2567 0.2292 0.2046 0.1827 0.1631 0.1456 0.1300 0.1161 0.1037 To Find A Given F A/F 1.0000 0.4717 0.2963 0.2092 0.1574 0.1232 0.0991 0.0813 0.0677 0.0570 0.0484 0.0414 0.0357 0.0309 0.0268 0.0234 0.0205 0.0179 0.0158 0.0139 To Find A Given P A/P 1.1200 0.5917 0.4163 0.3292 0.2774 0.2432 0.2191 0.2013 0.1877 0.1770 0.1684 0.1614 0.1557 0.1509 0.1468 0.1434 0.1405 0.1379 0.1358 0.1339 10 11 12 CHRBH56GB99 13 14 15 16 17 18 19 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts