Question: Consider the option from Week 12 Assignment: an ATM call with 3 months to expiry. The current stock price is $20, the risk-free rate is

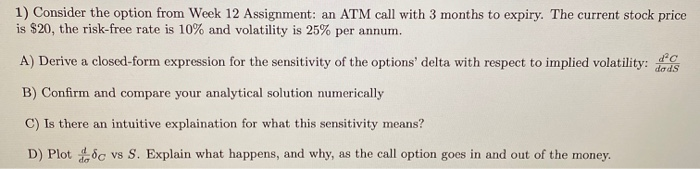

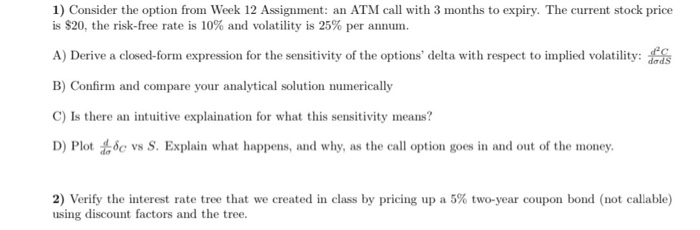

1) Consider the option from Week 12 Assignment: an ATM call with 3 months to expiry. The current stock price is $20, the risk-free rate is 10% and volatility is 25% per annum. A) Derive a closed-form expression for the sensitivity of the options' delta with respect to implied volatility: B) Confirm and compare your analytical solution numerically C) Is there an intuitive explaination for what this sensitivity means? D) Plot vs S. Explain what happens, and why, as the call option goes in and out of the money. 1) Consider the option from Week 12 Assignment: an ATM call with 3 months to expiry. The current stock price is $20, the risk-free rate is 10% and volatility is 25% per annum. A) Derive a closed-form expression for the sensitivity of the options' delta with respect to implied volatility: B) Confirm and compare your analytical solution numerically C) Is there an intuitive explaination for what this sensitivity means? D) Plot dc vs S. Explain what happens, and why, as the call option goes in and out of the money, 2) Verify the interest rate tree that we created in class by pricing up a 5% two-year coupon bond (not callable) using discount factors and the tree

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts