Question: Consider the original cost information data. In 2019, SI has been contacted by two international companies regarding special orders. Leopold Corporation, a Canadian company, would

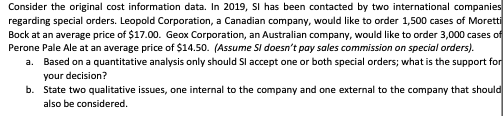

- Consider the original cost information data. In 2019, SI has been contacted by two international companies regarding special orders. Leopold Corporation, a Canadian company, would like to order 1,500 cases of Moretti Bock at an average price of $17.00. Geox Corporation, an Australian company, would like to order 3,000 cases of Perone Pale Ale at an average price of $14.50. (Assume SI doesnt pay sales commission on special orders).

- Based on a quantitative analysis only should SI accept one or both special orders; what is the support for your decision?

- State two qualitative issues, one internal to the company and one external to the company that should also be considered.

In 2015, Alex Montella quit his job at a large beer company to start his own brewery, Siena Brewery, Inc. (SI). His family supported his decision and invested in the business along with Alex. Siena Brewery doesn't pay income taxes. The company began operations on January 7, 2016 and now produces four labels of specialty beers (Perone Pale Ale, Moretti Bock, Nastro Blue Pilsner, and Menabrea Stout). In much of the United States, beer is sold in a "three-tier" system. Under this system, beer is manufactured by producers, sold to distributors, and then sold to retailers (such as liquor stores, drug stores, and grocery stores). Alex employs two salespeople who receive a fixed monthly salary plus a 8 percent commission. All beer is sold to beer distributors in cases of 24 bottles. Product sales and cost information for 2019 are shown in Exhibit 1 with additional information in Exhibit 2. Alex rents a facility that is used to make the beer, a refrigeration area to store the beer, and a small office area. Si Brewery has five machines with 9,000 total machine hours available per year to produce beer (assuming Si keeps its machines running on one shift with some normal maintenance, breaks, etc.). While there is an empty space in the facility that could be used to expand the beer operations, the company would need to purchase an additional grain hopper and brew house for about $100,000 (the current water system and process control system could be expanded to handle the new machine). Beers are aged in a refrigeration area prior to sale. The current refrigeration unit allows for different temperatures in different areas of the unit and the unit is usually running about 80 percent full. Keeping the refrigeration unit somewhat full helps reduce refrigeration costs. Additionally, since the company is so new, sales have been growing but erratically (from 2016 to 2017, sales growth was over 45 percent; however, from 2018 to 2019, sales growth was only 15 percent). Thus, keeping more beer on hand allows the company to meet the erratic demand without loss of sales. Alex has not taken a salary since the business started. While the business has been generating a small profit, Alex has been reinvesting the earnings in the business. He wants to grow the business to generate more profit for his family and Thimself Alex has been considering increasing the price on Menebrea Stout from $25.50 per case to $28.00 per case. He thinks that, with this price increase, unit sales will decrease from 4,050 cases to 3,620 cases per year. Alternatively, Alex could drop the price of Menebrea Stout to $23.75 per case. This is much closer to the Moretti Bock price as well as the Nastro Blue Pilsner. Based on his market research, he thinks that this will result in Menebrea Stout sales increasing to 4,615 cases per year. While the company has some cash on hand, neither the company nor Alex's family have another $100,000 to invest in the business right now for a new grain hopper and brew house. Since the business is new and has been showing only small profits, Alex has not been able to get a loan to expand the business. Instead, Alex wants to fully utilize the machines they already have. In 2019, they used around 8,000 machine hours (as shown in Exhibit 1) and the existing five machines have a total of 9,000 machine hours available during the year (assuming normal maintenance and some repairs needed during the year). Thus, the existing machines have around 1,000 additional hours available for use. Alex wants to keep producing and selling all four of his product lines because many of the beer distributors like buying from breweries that offer several different beers. However, he wants to direct the salespeople to emphasize a certain product when they are out talking to the beer distributors. Given the current machine availability, Alex is not sure what beer product line to tell the salespeople to emphasize in order to maximize his profits. Consider the original cost information data. In 2019, Si has been contacted by two international companies regarding special orders. Leopold Corporation, a Canadian company, would like to order 1,500 cases of Moretti Bock at an average price of $17.00. Geox Corporation, an Australian company, would like to order 3,000 cases of Perone Pale Ale at an average price of $14.50. (Assume Si doesn't pay sales commission on special orders). a. Based on a quantitative analysis only should Si accept one or both special orders; what is the support for your decision? b. State two qualitative issues, one internal to the company and one external to the company that should also be considered In 2015, Alex Montella quit his job at a large beer company to start his own brewery, Siena Brewery, Inc. (SI). His family supported his decision and invested in the business along with Alex. Siena Brewery doesn't pay income taxes. The company began operations on January 7, 2016 and now produces four labels of specialty beers (Perone Pale Ale, Moretti Bock, Nastro Blue Pilsner, and Menabrea Stout). In much of the United States, beer is sold in a "three-tier" system. Under this system, beer is manufactured by producers, sold to distributors, and then sold to retailers (such as liquor stores, drug stores, and grocery stores). Alex employs two salespeople who receive a fixed monthly salary plus a 8 percent commission. All beer is sold to beer distributors in cases of 24 bottles. Product sales and cost information for 2019 are shown in Exhibit 1 with additional information in Exhibit 2. Alex rents a facility that is used to make the beer, a refrigeration area to store the beer, and a small office area. Si Brewery has five machines with 9,000 total machine hours available per year to produce beer (assuming Si keeps its machines running on one shift with some normal maintenance, breaks, etc.). While there is an empty space in the facility that could be used to expand the beer operations, the company would need to purchase an additional grain hopper and brew house for about $100,000 (the current water system and process control system could be expanded to handle the new machine). Beers are aged in a refrigeration area prior to sale. The current refrigeration unit allows for different temperatures in different areas of the unit and the unit is usually running about 80 percent full. Keeping the refrigeration unit somewhat full helps reduce refrigeration costs. Additionally, since the company is so new, sales have been growing but erratically (from 2016 to 2017, sales growth was over 45 percent; however, from 2018 to 2019, sales growth was only 15 percent). Thus, keeping more beer on hand allows the company to meet the erratic demand without loss of sales. Alex has not taken a salary since the business started. While the business has been generating a small profit, Alex has been reinvesting the earnings in the business. He wants to grow the business to generate more profit for his family and Thimself Alex has been considering increasing the price on Menebrea Stout from $25.50 per case to $28.00 per case. He thinks that, with this price increase, unit sales will decrease from 4,050 cases to 3,620 cases per year. Alternatively, Alex could drop the price of Menebrea Stout to $23.75 per case. This is much closer to the Moretti Bock price as well as the Nastro Blue Pilsner. Based on his market research, he thinks that this will result in Menebrea Stout sales increasing to 4,615 cases per year. While the company has some cash on hand, neither the company nor Alex's family have another $100,000 to invest in the business right now for a new grain hopper and brew house. Since the business is new and has been showing only small profits, Alex has not been able to get a loan to expand the business. Instead, Alex wants to fully utilize the machines they already have. In 2019, they used around 8,000 machine hours (as shown in Exhibit 1) and the existing five machines have a total of 9,000 machine hours available during the year (assuming normal maintenance and some repairs needed during the year). Thus, the existing machines have around 1,000 additional hours available for use. Alex wants to keep producing and selling all four of his product lines because many of the beer distributors like buying from breweries that offer several different beers. However, he wants to direct the salespeople to emphasize a certain product when they are out talking to the beer distributors. Given the current machine availability, Alex is not sure what beer product line to tell the salespeople to emphasize in order to maximize his profits. Consider the original cost information data. In 2019, Si has been contacted by two international companies regarding special orders. Leopold Corporation, a Canadian company, would like to order 1,500 cases of Moretti Bock at an average price of $17.00. Geox Corporation, an Australian company, would like to order 3,000 cases of Perone Pale Ale at an average price of $14.50. (Assume Si doesn't pay sales commission on special orders). a. Based on a quantitative analysis only should Si accept one or both special orders; what is the support for your decision? b. State two qualitative issues, one internal to the company and one external to the company that should also be considered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts