Question: Consider the problem above. Heilo Inc. is considering restructuring its financing and increasing the use of debt to 40%. That change will result in a

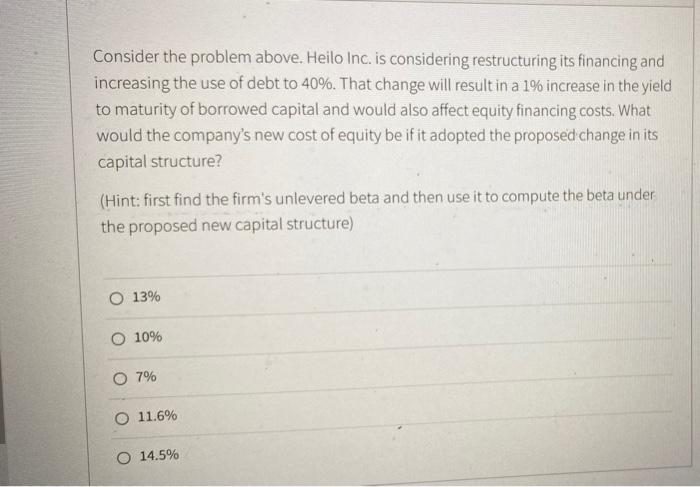

Consider the problem above. Heilo Inc. is considering restructuring its financing and increasing the use of debt to 40%. That change will result in a 1% increase in the yield to maturity of borrowed capital and would also affect equity financing costs. What would the company's new cost of equity be if it adopted the proposed change in its capital structure? (Hint: first find the firm's unlevered beta and then use it to compute the beta under the proposed new capital structure) O 13% O 10% O 7% O 11.6% O 14.5% Consider the problem above. Heilo Inc. is considering restructuring its financing and increasing the use of debt to 40%. That change will result in a 1% increase in the yield to maturity of borrowed capital and would also affect equity financing costs. What would the company's new cost of equity be if it adopted the proposed change in its capital structure? (Hint: first find the firm's unlevered beta and then use it to compute the beta under the proposed new capital structure) O 13% O 10% O 7% O 11.6% O 14.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts