Question: Consider the project contained in problem 7 in Chapter 11 (California Health Center). A. Perform a sensitivity analysis to see how NVP is affected by

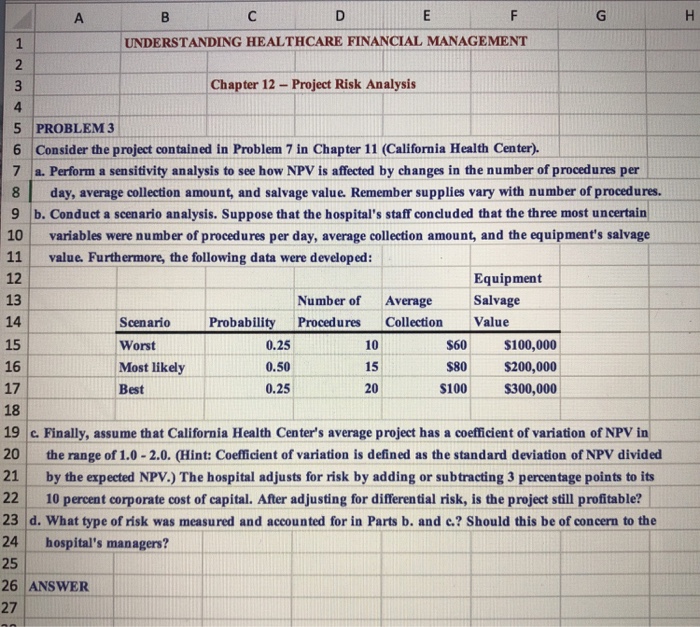

UNDERSTANDING HEALTHCARE FINANCIAL MANAGEMENT Chapter 12-Project Risk Analysis 5 PROBLEM 3 6 Consider the project contained in Problem 7 in Chapter 11 (California Health Center). 7 a. Perform a sensitivity analysis to see how NPV is affected by changes in the number of procedures per 8 day, average collection amount, and salvage value. Remember supplies vary with number of procedures. 9 b. Conduct a scenario analysis. Suppose that the hospital's staff concluded that the three most uncertain 10 variables were number of procedures per day, average collection amount, and the equipment's salvage 11 value. Furthermore, the following data were developed: 12 13 14 15 16 17 18 19 c. Finally, assume that California Health Center's average project has a coefficient of variation of NPV in 20 the range of 1.0-2.0. (Hint: Coefficient of variation is defined as the standard deviation of NPV divided 21 by the expected NPV.) The hospital adjusts for risk by adding or subtracting 3 percentage points to its 22 10 percent corporate cost of capital. After adjusting for differential risk, is the projeet still profitable? 23 d. What type of risk was measured and accounted for in Parts b. and c.? Should this be of concern to the 24 hospital's managen? 25 26 ANSWER 27 Equipment Number of Average Salvage Scenario Probability Procedures Collection Value Worst Most likely Best 0.25 0.50 0.25 10 15 20 $60 $80 $200,000 100 S300,000 $100,000 UNDERSTANDING HEALTHCARE FINANCIAL MANAGEMENT Chapter 12-Project Risk Analysis 5 PROBLEM 3 6 Consider the project contained in Problem 7 in Chapter 11 (California Health Center). 7 a. Perform a sensitivity analysis to see how NPV is affected by changes in the number of procedures per 8 day, average collection amount, and salvage value. Remember supplies vary with number of procedures. 9 b. Conduct a scenario analysis. Suppose that the hospital's staff concluded that the three most uncertain 10 variables were number of procedures per day, average collection amount, and the equipment's salvage 11 value. Furthermore, the following data were developed: 12 13 14 15 16 17 18 19 c. Finally, assume that California Health Center's average project has a coefficient of variation of NPV in 20 the range of 1.0-2.0. (Hint: Coefficient of variation is defined as the standard deviation of NPV divided 21 by the expected NPV.) The hospital adjusts for risk by adding or subtracting 3 percentage points to its 22 10 percent corporate cost of capital. After adjusting for differential risk, is the projeet still profitable? 23 d. What type of risk was measured and accounted for in Parts b. and c.? Should this be of concern to the 24 hospital's managen? 25 26 ANSWER 27 Equipment Number of Average Salvage Scenario Probability Procedures Collection Value Worst Most likely Best 0.25 0.50 0.25 10 15 20 $60 $80 $200,000 100 S300,000 $100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts