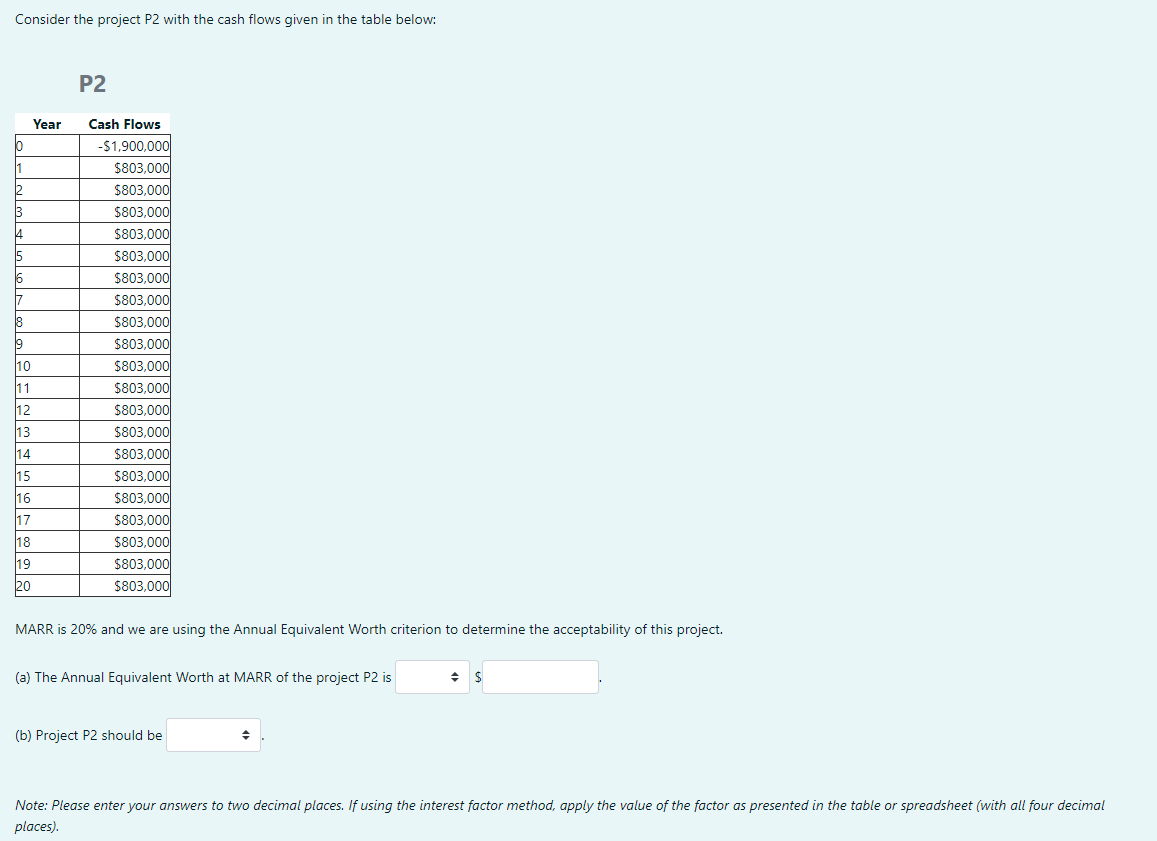

Question: Consider the project P2 with the cash flows given in the table below: P2 Year 0 11 12 3 4 15 16 17 18 19

Consider the project P2 with the cash flows given in the table below: P2 Year 0 11 12 3 4 15 16 17 18 19 Cash Flows -$1,900,000 $803,000 $803,000 $803,000 $803,000 $803,000 $803,000 $803,000 $803,000 $803,000 $803,000 $803,000 $803,000 $803,000 $803,000 $803,000 $803,000 $803,000 $803,000 $803,000 $803,000 10 11 12 13 14 15 16 17 18 19 20 MARR is 20% and we are using the Annual Equivalent Worth criterion to determine the acceptability of this project. (a) The Annual Equivalent Worth at MARR of the project P2 is (b) Project P2 should be Note: Please enter your answers to two decimal places. If using the interest factor method, apply the value of the factor as presented in the table or spreadsheet (with all four decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts