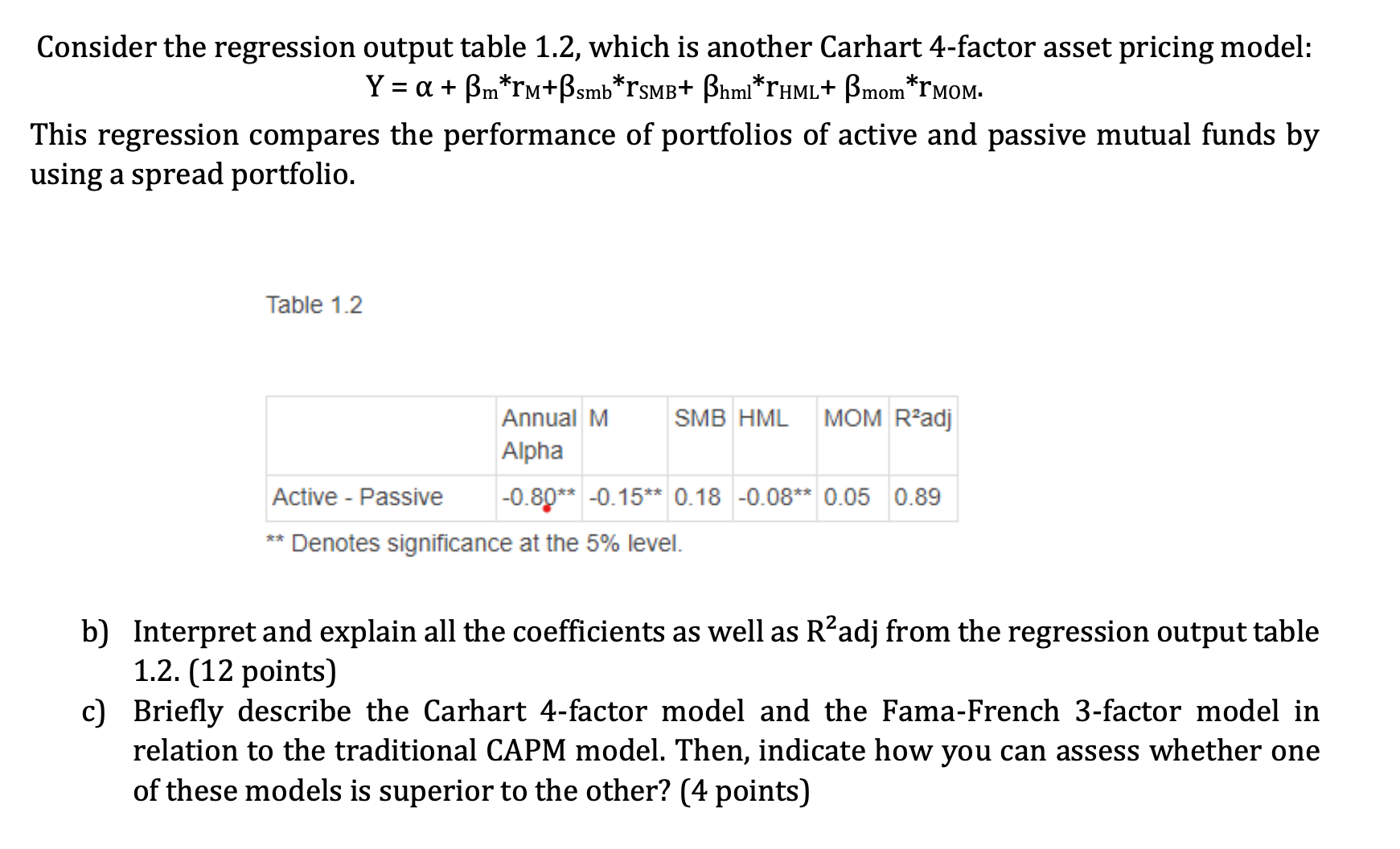

Question: Consider the regression output table 1.2, which is another Carhart 4-factor asset pricing model: = + m*r+smb*rSMB+ hml*rHML+ mom*rOM. Y = This regression compares

Consider the regression output table 1.2, which is another Carhart 4-factor asset pricing model: = + m*r+smb*rSMB+ hml*rHML+ mom*rOM. Y = This regression compares the performance of portfolios of active and passive mutual funds by using a spread portfolio. Table 1.2 Annual M Alpha SMB HML MOM Radj -0.80** -0.15** 0.18 -0.08** 0.05 0.89 Active - Passive ** Denotes significance at the 5% level. b) Interpret and explain all the coefficients as well as R adj from the regression output table 1.2. (12 points) c) Briefly describe the Carhart 4-factor model and the Fama-French 3-factor model in relation to the traditional CAPM model. Then, indicate how you can assess whether one of these models is superior to the other? (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts