Question: Consider the same economy as in last question, except that we assume there is only labor income tax 7 available now for the government

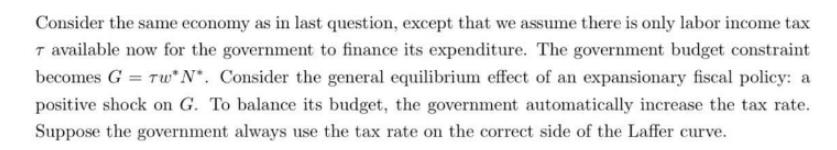

Consider the same economy as in last question, except that we assume there is only labor income tax 7 available now for the government to finance its expenditure. The government budget constraint becomes G = Tw* N. Consider the general equilibrium effect of an expansionary fiscal policy: a positive shock on G. To balance its budget, the government automatically increase the tax rate. Suppose the government always use the tax rate on the correct side of the Laffer curve. 1. Taken wage, profit, tax rate as given, solve the consumer's optimization problem (write out equilibrium consumption, outputs, working hours, and real wage). 2. Taken wage as given, solve the firm's optimization problem. 3. Write down all the equilibrium conditions that fully characterizes the competitive equilibrium (You don't need to solve the system of equations). 4. Analyze the effects of an increase in government spending. More specifically, given these equilibrium conditions, what happens to consumption, output, employment, wage and con- sumers' welfare after a positive shock on G? You can use the above solutions or illustrate using appropriate graphs. The consumer's welfare is indicated by his/her utility level at optimum.

Step by Step Solution

There are 3 Steps involved in it

This appears to be a multistep economic modeling problem that requires detailed calculations and ana... View full answer

Get step-by-step solutions from verified subject matter experts