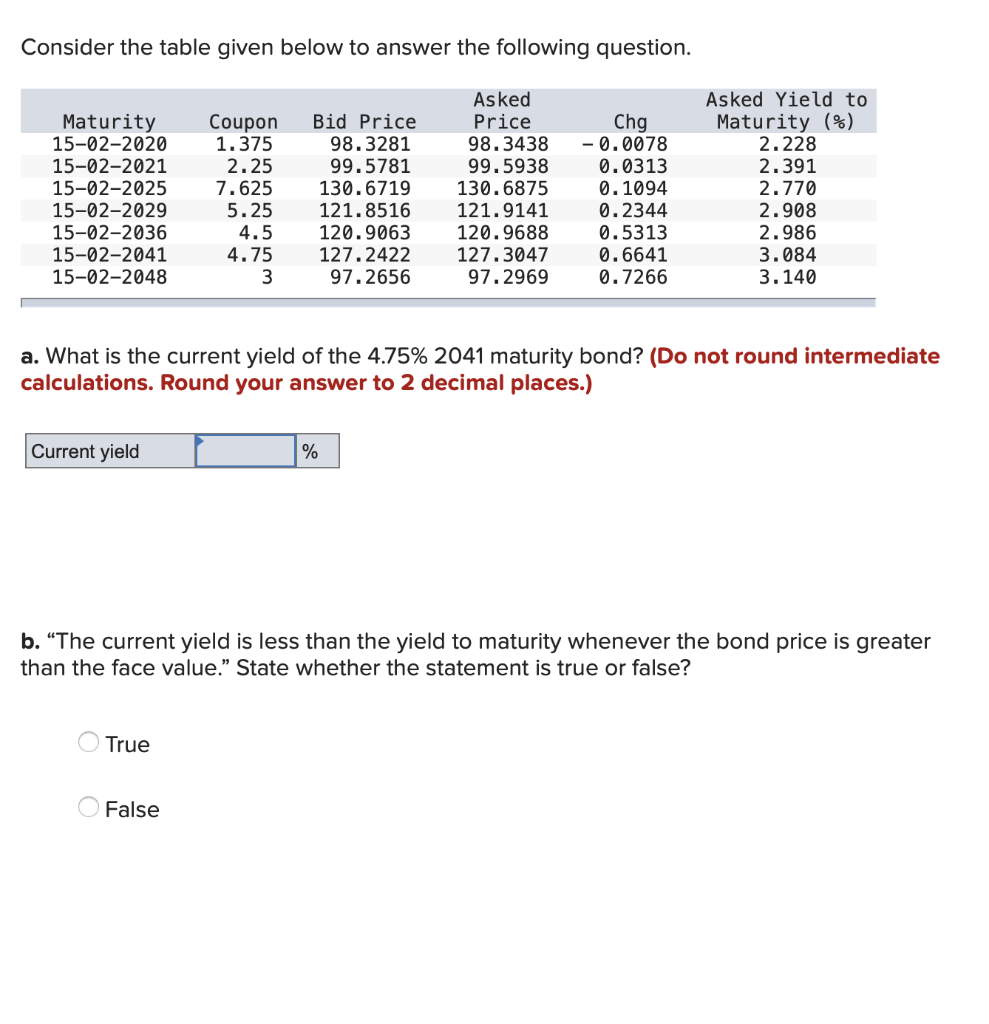

Question: Consider the table given below to answer the following question. aa2 Maturity 15-02-2020 15-02-2021 15-02-2025 15-02-2029 15-02-2036 15-02-2041 15-02-2048 Coupon 1.375 2.25 7.625 5.25 4.5

Consider the table given below to answer the following question. aa2 Maturity 15-02-2020 15-02-2021 15-02-2025 15-02-2029 15-02-2036 15-02-2041 15-02-2048 Coupon 1.375 2.25 7.625 5.25 4.5 4.75 3 Bid Price 98.3281 99.5781 130.6719 121.8516 120.9063 127.2422 97.2656 Asked Price 98.3438 99.5938 130.6875 121.9141 120.9688 127.3047 97.2969 Chg -0.0078 0.0313 0.1094 0.2344 0.5313 0.6641 0.7266 Asked Yield to Maturity (%) 2.228 2.391 2.770 2.908 2.986 3.084 3.140 a. What is the current yield of the 4.75% 2041 maturity bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Current yield b. The current yield is less than the yield to maturity whenever the bond price is greater than the face value." State whether the statement is true or false? O True O False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts