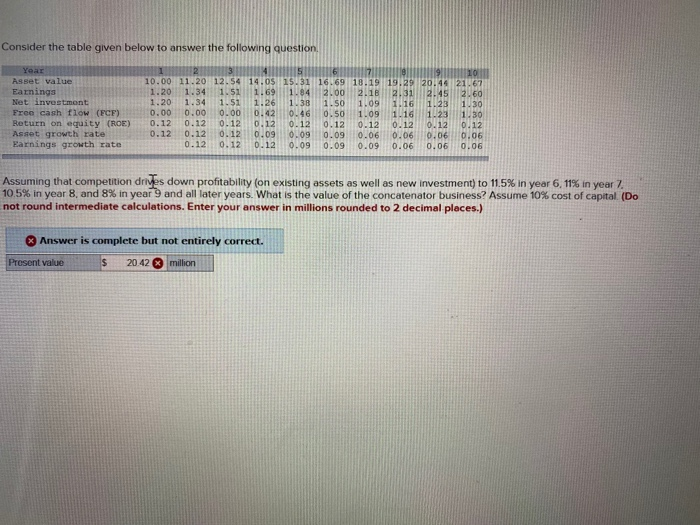

Question: Consider the table given below to answer the following question YAT Asset value Earnings Net investment Free cash flow (FCF) Return on equity (ROE) Asset

Consider the table given below to answer the following question YAT Asset value Earnings Net investment Free cash flow (FCF) Return on equity (ROE) Asset growth rate Earnings growth rate 10.00 11.20 12.54 14.05 15.31 16.69 10.1919.29 20:44 21167 1.20 1.34 1.51 1.69 1.84 2.00 2.18 2.31 2.45 2.60 1.20 1.34 1.51 1.26 138 1.50 1.09 1.16 1.23 130 0.00 0.00 0.42 0.46 0.50 1.09 1.16 1.23 1.30 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.09 0.09 0.09 0.06 0.06 0.06 0.12 0.12 0.12 0.09 0.09 0.09 0.06 0.06 0.06 0.00 0.06 Assuming that competition drives down profitability (on existing assets as well as new investment) to 11.5% in year 6, 11% in year 7. 10.5% in year 8, and 8% in year 9 and all later years. What is the value of the concatenator business? Assume 10% cost of capital (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Answer is complete but not entirely correct. Present value $ million 20 42 Consider the table given below to answer the following question YAT Asset value Earnings Net investment Free cash flow (FCF) Return on equity (ROE) Asset growth rate Earnings growth rate 10.00 11.20 12.54 14.05 15.31 16.69 10.1919.29 20:44 21167 1.20 1.34 1.51 1.69 1.84 2.00 2.18 2.31 2.45 2.60 1.20 1.34 1.51 1.26 138 1.50 1.09 1.16 1.23 130 0.00 0.00 0.42 0.46 0.50 1.09 1.16 1.23 1.30 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.09 0.09 0.09 0.06 0.06 0.06 0.12 0.12 0.12 0.09 0.09 0.09 0.06 0.06 0.06 0.00 0.06 Assuming that competition drives down profitability (on existing assets as well as new investment) to 11.5% in year 6, 11% in year 7. 10.5% in year 8, and 8% in year 9 and all later years. What is the value of the concatenator business? Assume 10% cost of capital (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Answer is complete but not entirely correct. Present value $ million 20 42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts