Question: Consider the three option strategies below with the same underlying stock and exercise date. X denotes the strike prices (in $). Strategy 1: Long two

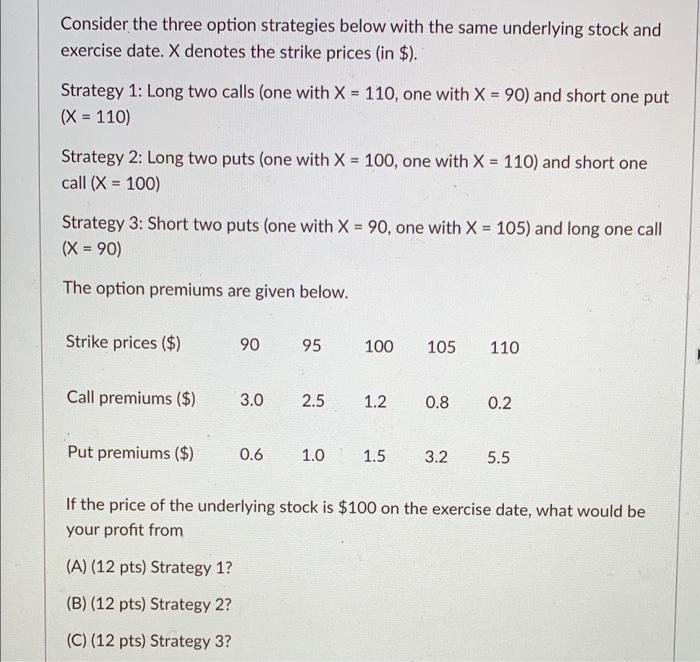

Consider the three option strategies below with the same underlying stock and exercise date. X denotes the strike prices (in $). Strategy 1: Long two calls (one with X = 110, one with X = 90) and short one put (X = 110) Strategy 2: Long two puts (one with X = 100, one with X = 110) and short one call (X = 100) Strategy 3: Short two puts (one with X = 90, one with X = 105) and long one call (X = 90) The option premiums are given below. Strike prices ($) 90 95 100 105 110 Call premiums ($) 3.0 2.5 1.2 0.8 0.2 Put premiums ($) 0.6 1.0 1.5 3.2 5.5 If the price of the underlying stock is $100 on the exercise date, what would be your profit from (A) (12 pts) Strategy 1? (B) (12 pts) Strategy 2? (C) (12 pts) Strategy 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts