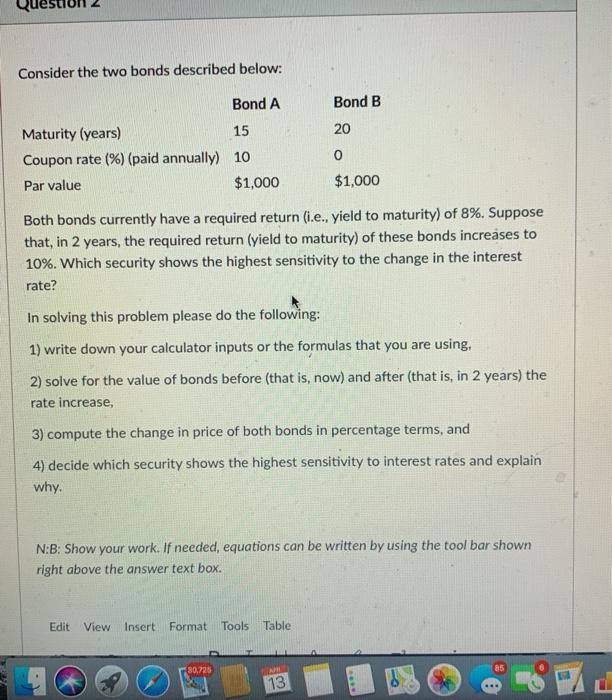

Question: Consider the two bonds described below: Bond A Bond B 20 Maturity (years) 15 Coupon rate (%) (paid annually) 10 Par value $1,000 o $1,000

Consider the two bonds described below: Bond A Bond B 20 Maturity (years) 15 Coupon rate (%) (paid annually) 10 Par value $1,000 o $1,000 Both bonds currently have a required return (i.e., yield to maturity) of 8%. Suppose that, in 2 years, the required return (yield to maturity) of these bonds increases to 10%. Which security shows the highest sensitivity to the change in the interest rate? In solving this problem please do the following: 1) write down your calculator inputs or the formulas that you are using, 2) solve for the value of bonds before (that is, now) and after (that is, in 2 years) the rate increase, 3) compute the change in price of both bonds in percentage terms, and 4) decide which security shows the highest sensitivity to interest rates and explain why. N:B: Show your work. If needed, equations can be written by using the tool bar shown right above the answer text box. Edit View Insert Format Tools Table 80,725 AN 13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts