Question: Consider the two capacity options for Arktec Manufacturing shown below. Suppose the company has identified the following three possible demand scenarios Click the icon to

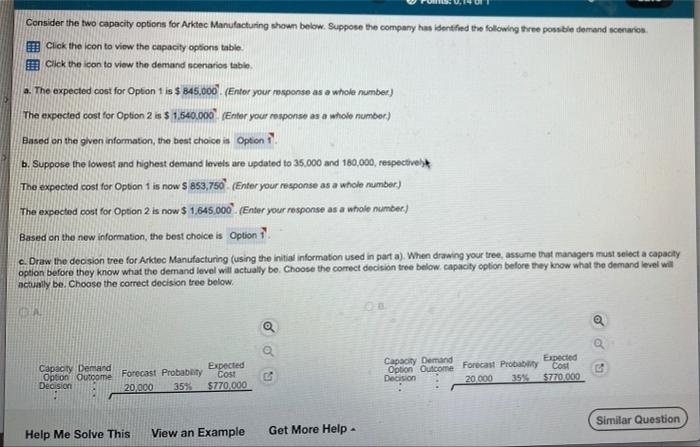

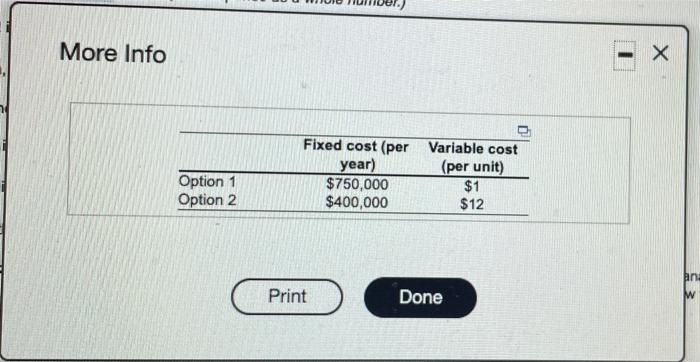

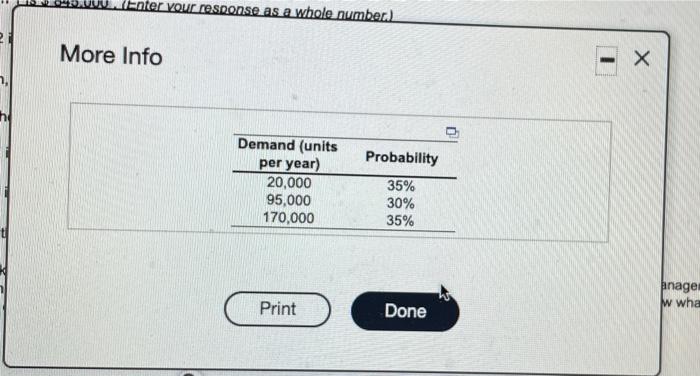

Consider the two capacity options for Arktec Manufacturing shown below. Suppose the company has identified the following three possible demand scenarios Click the icon to view the capacity options table Click the icon to view the demand scenarios table a. The expected cost for Option 1 is $ 845,000. (Enter your response as a whole number) The expected cost for Option 2 is $ 1,540.000 (Enter your response as a whole number) Based on the given information, the best choice is Option b. Suppose the lowest and highest demand levels are updated to 35,000 and 160,000, respectives The expected cost for Option 1 is now $ 853,750" (Enter your response as a whole number) The expected cost for Option 2 is now $ 1,645,000 (Enter your response as a whole number.) Based on the new information, the best choice is Option 11 c. Draw the deo sion tree for Arktec Manufacturing (using the initial information used in part a). When drawing your tree assume that managers must select a capacity option before they know what the demand level will actually be. Choose the correct decision tree below. Capacity option before they know what the demand level will actually be. Choose the correct decision tree below a Capacity Demand Expected Option Outcome Forecast Probability COSE Decision 20,000 35 $770.000 Capacity Demand Expected Option Outcome Forecast Probability cost Decision 20 000 35% $770.000 Similar Question Help Me Solve This View an Example Get More Help More Info X Option 1 Option 2 Fixed cost (per Variable cost year) (per unit) $750,000 $1 $400,000 $12 an Print Done WEnter your response as a whole number.) More Info 1 Probability Demand (units per year) 20,000 95,000 170,000 35% 30% 35% anage w wha Print Done Consider the two capacity options for Arktec Manufacturing shown below. Suppose the company has identified the following three possible demand scenarios Click the icon to view the capacity options table Click the icon to view the demand scenarios table a. The expected cost for Option 1 is $ 845,000. (Enter your response as a whole number) The expected cost for Option 2 is $ 1,540.000 (Enter your response as a whole number) Based on the given information, the best choice is Option b. Suppose the lowest and highest demand levels are updated to 35,000 and 160,000, respectives The expected cost for Option 1 is now $ 853,750" (Enter your response as a whole number) The expected cost for Option 2 is now $ 1,645,000 (Enter your response as a whole number.) Based on the new information, the best choice is Option 11 c. Draw the deo sion tree for Arktec Manufacturing (using the initial information used in part a). When drawing your tree assume that managers must select a capacity option before they know what the demand level will actually be. Choose the correct decision tree below. Capacity option before they know what the demand level will actually be. Choose the correct decision tree below a Capacity Demand Expected Option Outcome Forecast Probability COSE Decision 20,000 35 $770.000 Capacity Demand Expected Option Outcome Forecast Probability cost Decision 20 000 35% $770.000 Similar Question Help Me Solve This View an Example Get More Help More Info X Option 1 Option 2 Fixed cost (per Variable cost year) (per unit) $750,000 $1 $400,000 $12 an Print Done WEnter your response as a whole number.) More Info 1 Probability Demand (units per year) 20,000 95,000 170,000 35% 30% 35% anage w wha Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts