Question: Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate over the period was 4%, and the markets average

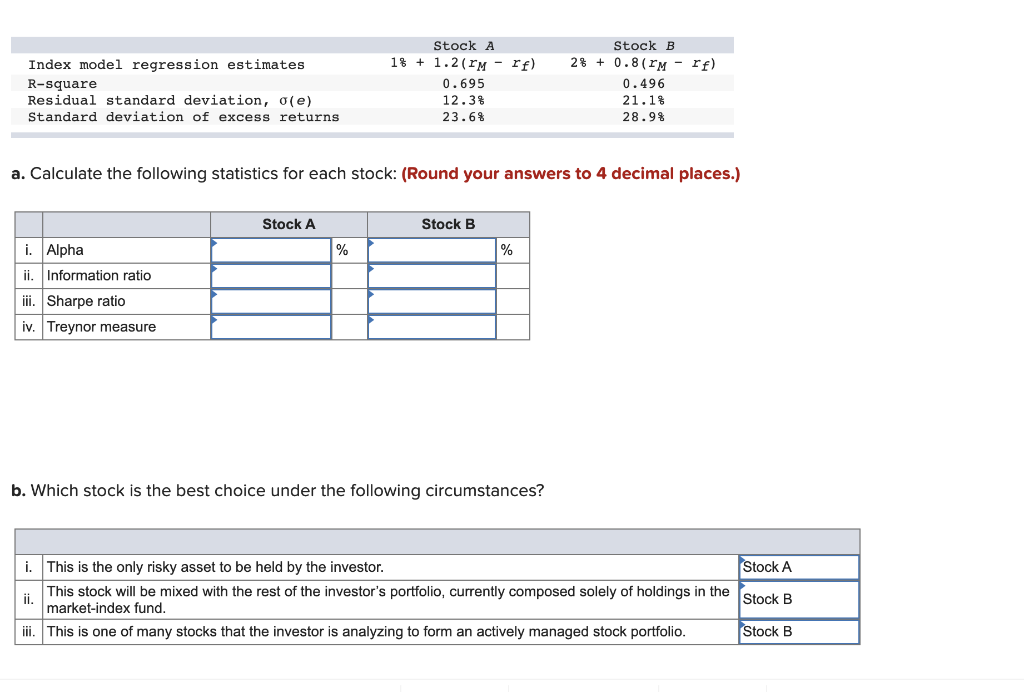

Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate over the period was 4%, and the markets average return was 13%. Performance is measured using an index model regression on excess returns.

Index model regression estimates R-square Residual standard deviation, (e) Standard deviation of excess returns Stock A 1% + 1.217M - rf) 0.695 12.3% 23.6% Stock B 2% + 0.8 (PM - rf) 0.496 21.1% 28.9% a. Calculate the following statistics for each stock: (Round your answers to 4 decimal places.) Stock A Stock B i. Alpha % % ii. Information ratio iii. Sharpe ratio iv. Treynor measure b. Which stock is the best choice under the following circumstances? i. This is the only risky asset to be held by the investor. Stock A This stock will be mixed with the rest of the investor's portfolio, currently composed solely of holdings in the Stock B market-index fund. iii. This is one of many stocks that the investor is analyzing to form an actively managed stock portfolio. Stock B Index model regression estimates R-square Residual standard deviation, (e) Standard deviation of excess returns Stock A 1% + 1.217M - rf) 0.695 12.3% 23.6% Stock B 2% + 0.8 (PM - rf) 0.496 21.1% 28.9% a. Calculate the following statistics for each stock: (Round your answers to 4 decimal places.) Stock A Stock B i. Alpha % % ii. Information ratio iii. Sharpe ratio iv. Treynor measure b. Which stock is the best choice under the following circumstances? i. This is the only risky asset to be held by the investor. Stock A This stock will be mixed with the rest of the investor's portfolio, currently composed solely of holdings in the Stock B market-index fund. iii. This is one of many stocks that the investor is analyzing to form an actively managed stock portfolio. Stock B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts