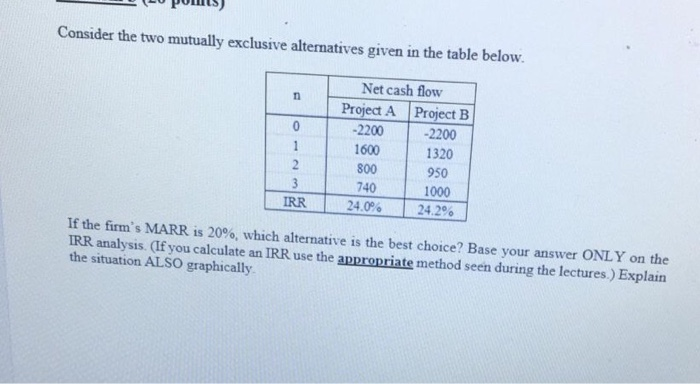

Question: Consider the two mutually exclusive alternatives given in the table below. n 0 Net cash flow Project A Project B -2200 -2200 1600 1320 950

Consider the two mutually exclusive alternatives given in the table below. n 0 Net cash flow Project A Project B -2200 -2200 1600 1320 950 740 1000 24.0 24.2 800 2 3 IRR If the firm's MARR is 20%, which alternative is the best choice? Base your answer ONLY on the IRR analysis. (If you calculate an IRR use the appropriate method seen during the lectures.) Explain the situation ALSO graphically Consider the two mutually exclusive alternatives given in the table below. n 0 Net cash flow Project A Project B -2200 -2200 1600 1320 950 740 1000 24.0 24.2 800 2 3 IRR If the firm's MARR is 20%, which alternative is the best choice? Base your answer ONLY on the IRR analysis. (If you calculate an IRR use the appropriate method seen during the lectures.) Explain the situation ALSO graphically

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts