Question: Consider the two mutually exclusive investment projects given in Table (a) To use the IRR criterion, what assumption must be made in comparing a set

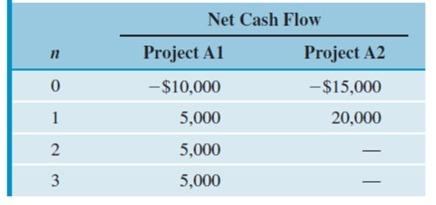

Consider the two mutually exclusive investment projects given in Table

(a) To use the IRR criterion, what assumption must be made in comparing a set of mutually exclusive investments with unequal service lives?

(b) With the assumption made in part (a), determine the range of MARRs which will indicate that project A1 should be selected.

Net Cash Flow 11 Project A1 Project A2 0 -$10,000 -$15,000 1 1 5,000 20,000 2 5,000 3 5,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts