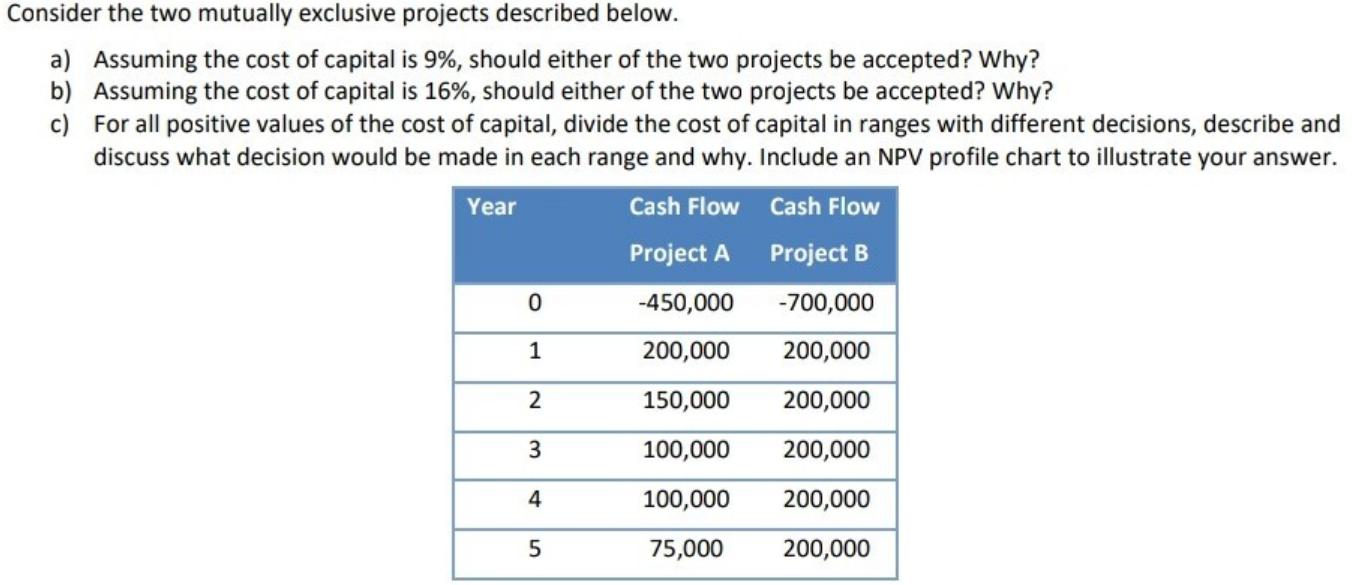

Question: Consider the two mutually exclusive projects described below. a) Assuming the cost of capital is 9%, should either of the two projects be accepted?

Consider the two mutually exclusive projects described below. a) Assuming the cost of capital is 9%, should either of the two projects be accepted? Why? b) Assuming the cost of capital is 16%, should either of the two projects be accepted? Why? c) For all positive values of the cost of capital, divide the cost of capital in ranges with different decisions, describe and discuss what decision would be made in each range and why. Include an NPV profile chart to illustrate your answer. Year Cash Flow Cash Flow Project A Project B -450,000 -700,000 1 200,000 200,000 2 150,000 200,000 100,000 200,000 4 100,000 200,000 5 75,000 200,000

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

a NPV Project A Rate 9 Time Cashflows PVF PV 0 45000000 1 45000000 1 20000000 0917431193 18348624 2 ... View full answer

Get step-by-step solutions from verified subject matter experts