Question: Consider the two-factor model as below: R_i= E(R_i) + B_1i* GDP + _2i*IR + e_i Suppose that on a particular day, some news suggests that

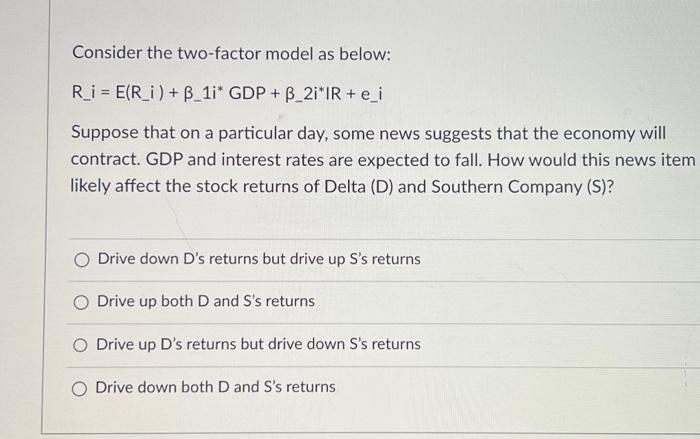

Consider the two-factor model as below: Ri=E(Ri)+1iGDP+2iIR+ei Suppose that on a particular day, some news suggests that the economy will contract. GDP and interest rates are expected to fall. How would this news item likely affect the stock returns of Delta (D) and Southern Company (S)? Drive down D's returns but drive up S's returns Drive up both D and S's returns Drive up D's returns but drive down S's returns Drive down both D and S 's returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts