Question: Consider the widget exchange. Suppose that each widget contract has a market value of $0 and a notional value of $100. There are three traders,

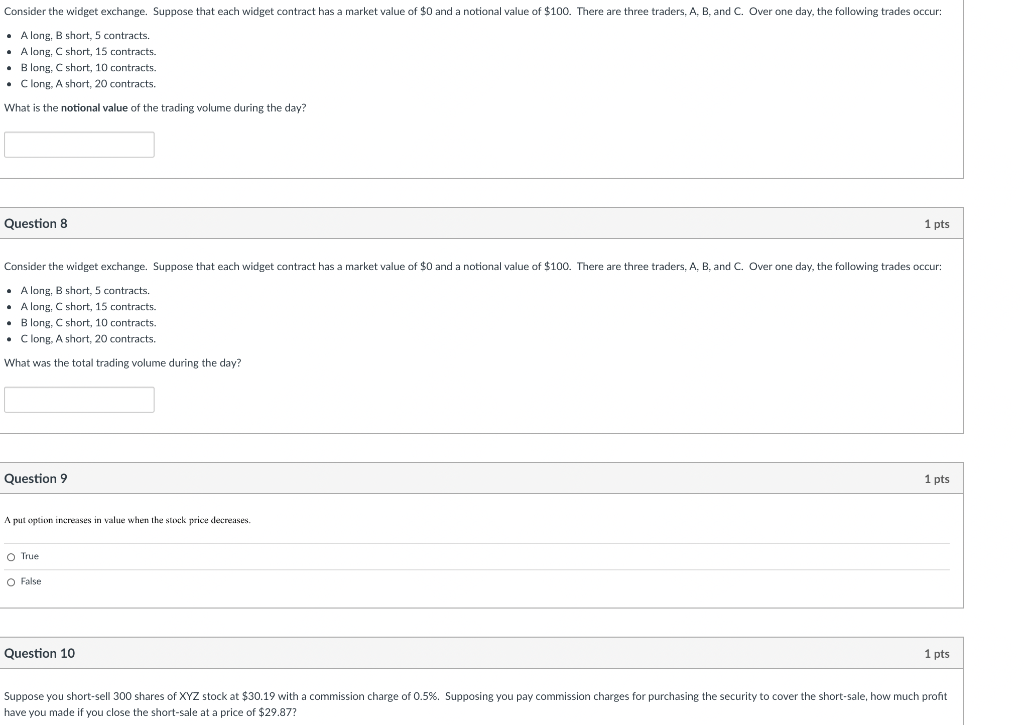

Consider the widget exchange. Suppose that each widget contract has a market value of $0 and a notional value of $100. There are three traders, A. B. and C. Over one day, the following trades occur: Along, B short, 5 contracts. A long, C short, 15 contracts. Blong, short, 10 contracts Clong, A short, 20 contracts. What is the notional value of the trading volume during the day? Question 8 1 pts Consider the widget exchange. Suppose that each widget contract has a market value of $0 and a notional value of $100. There are three traders, A. B. and C. Over one day, the following trades occur: Along, B short, 5 contracts. Along, C short, 15 contracts Blong, short, 10 contracts. Clong, A short, 20 contracts. What was the total trading volume during the day? Question 9 1 pts A put option increases in value when the stock price decreases O True O False Question 10 1 pts Suppose you short-sell 300 shares of XYZ stock at $30.19 with a commission charge of 0.5%. Supposing you pay commission charges for purchasing the security to cover the short-sale, how much profit have you made if you close the short-sale at a price of $29.87? Consider the widget exchange. Suppose that each widget contract has a market value of $0 and a notional value of $100. There are three traders, A. B. and C. Over one day, the following trades occur: Along, B short, 5 contracts. A long, C short, 15 contracts. Blong, short, 10 contracts Clong, A short, 20 contracts. What is the notional value of the trading volume during the day? Question 8 1 pts Consider the widget exchange. Suppose that each widget contract has a market value of $0 and a notional value of $100. There are three traders, A. B. and C. Over one day, the following trades occur: Along, B short, 5 contracts. Along, C short, 15 contracts Blong, short, 10 contracts. Clong, A short, 20 contracts. What was the total trading volume during the day? Question 9 1 pts A put option increases in value when the stock price decreases O True O False Question 10 1 pts Suppose you short-sell 300 shares of XYZ stock at $30.19 with a commission charge of 0.5%. Supposing you pay commission charges for purchasing the security to cover the short-sale, how much profit have you made if you close the short-sale at a price of $29.87

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts