Question: Consider the Williamson model for horizontal mergers that we discussed in class. Sup- pose that demand is given by P = 200 Q and that

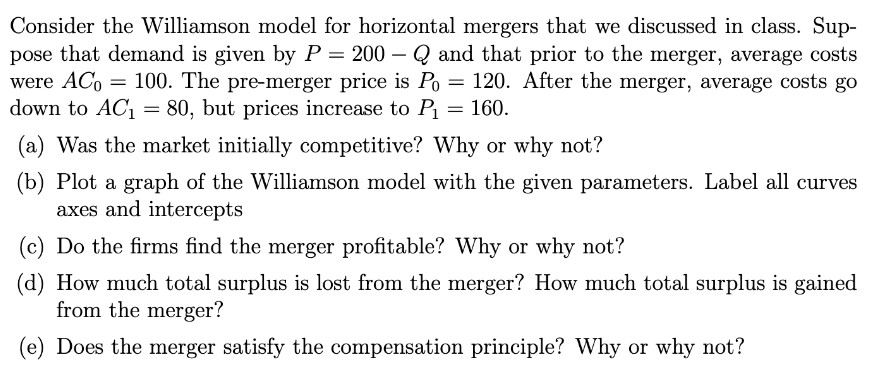

Consider the Williamson model for horizontal mergers that we discussed in class. Sup- pose that demand is given by P = 200 Q and that prior to the merger, average costs were ACD = 100. The premerger price is Pg = 120. After the merger, average costs go down to A01 = 80, but prices increase to P1 = 160. (a) Was the market initially competitive? Why or why not? ([3) Plot a graph of the Williamson model with the given parameters. Label all curves axes and intercepts (o) Do the rms nd the merger protable? Why or why not? (d) How much total surplus is lost from the merger? How much total surplus is gained from the merger? (e) Does the merger satisfy the compensation principle? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts