Question: Consider there are two projects Project A and Project B. Project A's economic life is 4 years, Project B's economic life is 3 years. Both

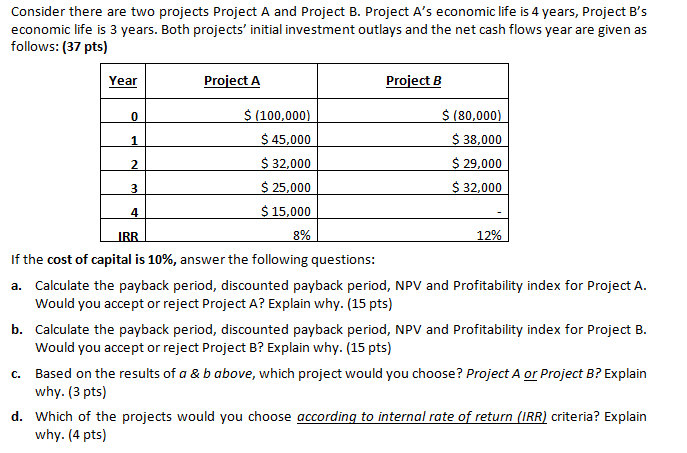

Consider there are two projects Project A and Project B. Project A's economic life is 4 years, Project B's economic life is 3 years. Both projects' initial investment outlays and the net cash flows year are given as follows: (37 pts) Year Project A Project B 0 $ (100,000) $ 45,000 $ (80,000) $ 38,000 1 2 $ 32,000 $ 29,000 $ 32,000 3 $ 25,000 4 IRR 8% $ 15,000 12% If the cost of capital is 10%, answer the following questions: a. Calculate the payback period, discounted payback period, NPV and Profitability index for Project A. Would you accept or reject Project A? Explain why. (15 pts) b. Calculate the payback period, discounted payback period, NPV and Profitability index for Project B. Would you accept or reject Project B? Explain why. (15 pts) C. Based on the results of a & b above, which project would you choose? Project A or Project B? Explain why. (3 pts) d. Which of the projects would you choose according to internal rate of return (IRR) criteria? Explain why. (4 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts