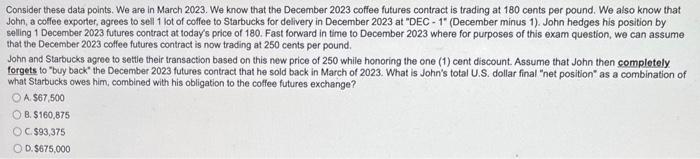

Question: Consider these data points. We are in March 2023 . We know that the December 2023 coffee futures contract is trading at 180 cents per

Consider these data points. We are in March 2023 . We know that the December 2023 coffee futures contract is trading at 180 cents per pound. We also know that John, a colfee exporter, agrees to sell 1 lot of coffee to Starbucks for delivery in December 2023 at "DEC - 1 " (December minus 1). John hedges his position by selling 1 December 2023 futures contract at today's price of 180 . Fast forward in time to December 2023 where for purposes of this exam question, we can assume that the December 2023 coffee futures contract is now trading at 250 cents per pound. John and Starbucks agree to settle their transaction based on this new price of 250 while honoring the one (1) cent discount. Assume that John then completely forgets to "buy back" the December 2023 futures contract that he sold back in March of 2023 . What is John's total U.S. dollar final "net position" as a combination of what Starbucks owes him, combined with his obligation to the coffee futures exchange? A. 967,500 B. 5160.875 C. $93.375 D. $675,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts